Over the centuries, various transformations have disrupted economies. Think of the shift from horse-drawn carriages to automobiles, or the automation of factories as machines replace manual workers. While these bring the benefits of increased mobility and cost-effective production, they also have their drawbacks.

When horse power was replaced by automobiles, carriage builders and drivers lost their livelihoods, and related companies such as blacksmiths lost income. Historically, equity and inclusion have not been key considerations during such transitions.

As we witness another major global shift – from fossil fuels to clean energy – large swaths of the workforce across the traditional power generation value chain will be affected. This time, we have an opportunity to achieve equity, inclusion and 'only'.

India's dependence on conventional energy

Large-scale fossil fuel power generation infrastructure has historically been a major driver of the Indian economy, with utilities playing a nation-builder role in this area. Domestic fossil fuels have also made the country energy independent, ensuring millions of people have access to electricity, even in remote areas.

Trends in coal production and related infrastructure investment indicate that despite the country’s ambitious target of 500 GW of renewable and non-fossil fuel installation capacity to meet 50% of energy demand by 2020, coal consumption will remain low in the near future. will be on an upward trend. It is expected that solid fossil fuel use may plateau by the middle of the next decade and then gradually decline.

The shift to clean energy will bring the benefits of climate change mitigation, cleaner air and new growth industries, but it will also bring economic challenges. These may be more pronounced in the mineral-rich states of India, where many economic activities surrounding the extraction and consumption of solid fossil fuels may be fundamentally changed. The central and eastern states of India's Gondwana belt were the epicenter of this event. The five resource-rich eastern states of Chhattisgarh, Jharkhand, Madhya Pradesh, Odisha and West Bengal together account for about 85% of the country's solid fossil fuel production. They rely heavily on mining and downstream industries (mainly power generation) for economic output, employment, state revenue and social welfare funding.

Deeper into Jharkhand

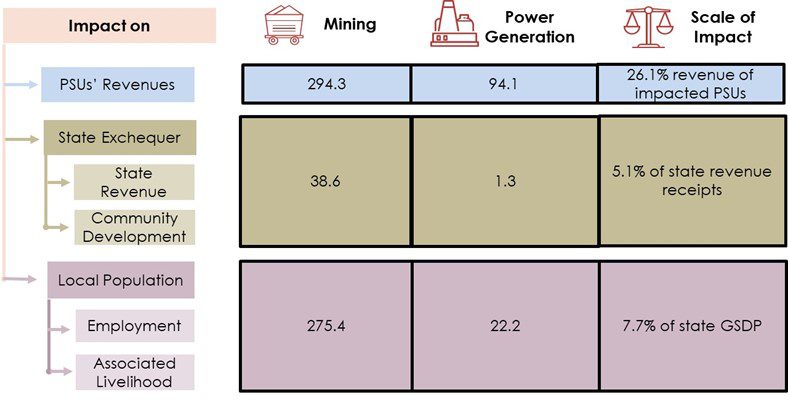

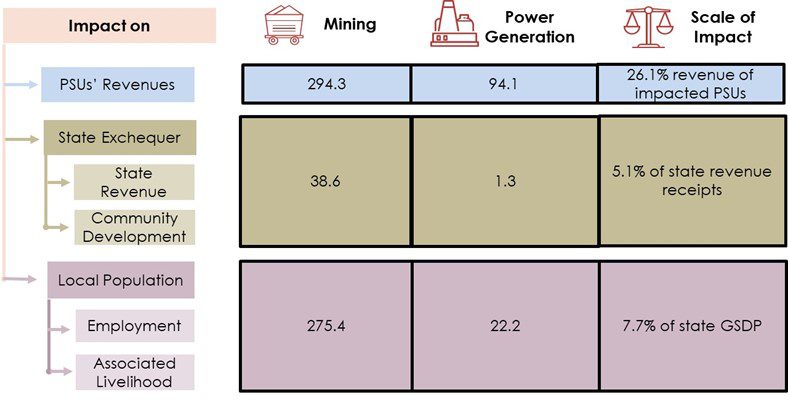

According to CPI’s recent vulnerability assessment, Jharkhand is one of the regions most likely to face short-term adverse impacts of the low-carbon transition. Subsequent CPI research highlighted the significant economic impact of a low-carbon transition on Jharkhand, which could amount to INR 725.9 billion (USD 8.7 billion) per year. While this is an overall measure, the fiscal impact on Jharkhand will include:

- The impact on state revenue is 5.1% of current levels.

- The loss of livelihoods could lead to a 7.7% decline in the state's gross domestic product (GSDP).

This transition will impact various stakeholders, including public sector undertakings (PSUs), state governments, workers across the mining and power generation value chain, and communities living close to operations, as shown in the graphic below.

All figures are in billions of Indian rupees and represent the revenue or reduction in revenue due to divestment from fossil fuels (INR 1 billion = USD 120 million as of December 2023)

As renewable energy becomes increasingly cost-competitive and India moves toward net-zero emissions goals, renewable energy-rich countries may begin to play a larger role in India's energy mix, which would reduce reliance on solid fossil fuels and Demand based on the output of solid fossil fuels. This may affect stakeholders in Jharkhand and other similar states in the following ways:

- power supply unit Companies engaged in the extraction of solid fossil fuel power generation will lose revenue as their products become less competitive in India driven by green energy. Power producers have viable options for adopting clean technologies, but mining companies may have limited avenues beyond diversifying their core businesses.

- national finance Public institutions and private companies will receive less tax revenue if their fossil fuel operations decline. It will also face a loss of revenue from sources such as mining royalties, regional mineral fund trusts, land taxes and transit fees. At the same time, it will also face growing social spending needs to support workers that the transition will disrupt.

- community If these businesses cease operations, residents near the project site may be affected as it will also lead to the end of various community development projects. Public institutions often undertake projects in health care, educational facilities, capacity building, etc., either under mandate or to generate goodwill.

- Permanent and contract workers The labor-intensive mining and power generation industries will suffer severe but differentiated employment-related impacts. Long-term employees may be less affected by the transition as they may receive employment or severance packages in other locations, including under India's voluntary retirement scheme. On the other hand, contract workers may not be able to access such benefits, given the more limited support provided by the country’s labor laws.

- related livelihoods Local economies (induced employment) centered around mines and power plants will also be significantly affected by the transition. Given that many of these roles are informal (e.g. hotels, restaurants, grocery stores, laundromats, etc.), they may have little opportunity to receive assistance from the government or public institutions. While some workers may migrate to areas where new industries or renewable energy power plants are being built, this is only possible for some. Many workers also rely on ancestral agricultural land and livestock for income and will benefit from government investment to create jobs in their hometowns.

What else needs to be done?

Our assessment highlights that the low-carbon energy transition could have significant impacts on Jharkhand and other resource-rich states. Several policy and financing interventions are needed to offset adverse impacts. Investment in alternative industries and livelihoods is needed, including large-scale workforce retraining, job creation and targeted social spending.

A lot of planning is required to develop a suitable roadmap to ensure the transformation delivers benefits for everyone. This roadmap requires an estimate of the annual incremental investment required in emerging technologies relative to the decline in stakeholder revenue or traditional resource revenue. It is also critical to identify the right sources of funding and develop a framework to help funds flow to where necessary.

Future CPI work will examine these intricacies to identify financial needs and sources and develop frameworks that can help achieve a just transformation of financial flows.