The majority of the $47 billion in green tax credits claimed between 2006 and 2021 went to higher-income households, according to a new study released Monday by the National Bureau of Economic Research. [emphasis, links added]

The top 20% of households in the country receive about 60% of the clean energy tax credits, while the bottom 60% receive only 10%according to a paper written by Severin Borenstein and Lucas W. Davis, two economists at the University of California, Berkeley.

The pattern of high-income filers claiming the bulk of green tax credits has remained “relatively stable” It was not until the introduction of electric vehicle (EV) credit in 2018 that the proportion experienced a “slight expansion.”

In the case of electric vehicles, the top 20% of earners receive 80% of the points, while the top 5% receive 50%according to research.

There is also only a small correlation between larger green tax credits and the adoption of technologies such as heat pumps, solar panels and electric vehicles.

“The cost-effectiveness of tax credits depends on their ability to increase the adoption of clean energy technologies,” the study states. “Overall, we find little correlation between tax credits and technology adoption.”

For example, The paper found no evidence that heat pump shipments responded to any of the five policy changes in heat pump subsidies between 2006 and 2021.

“[A] The credit was launched in 2006, but adoption declined that year,” the study said. “Credit was not available in 2008 and 2018, but Heat pump shipments have not declined significantly over the years.

“Furthermore, between 2009 and 2010, credit increased from 10% to 30%, but Heat pump shipments have not increased significantly over the years.

“Finally, and perhaps most strikingly, Starting in 2023, the tax credit increases from 10% to 30%, But not increase, Between 2022 and 2023, shipments fell by 16%.“

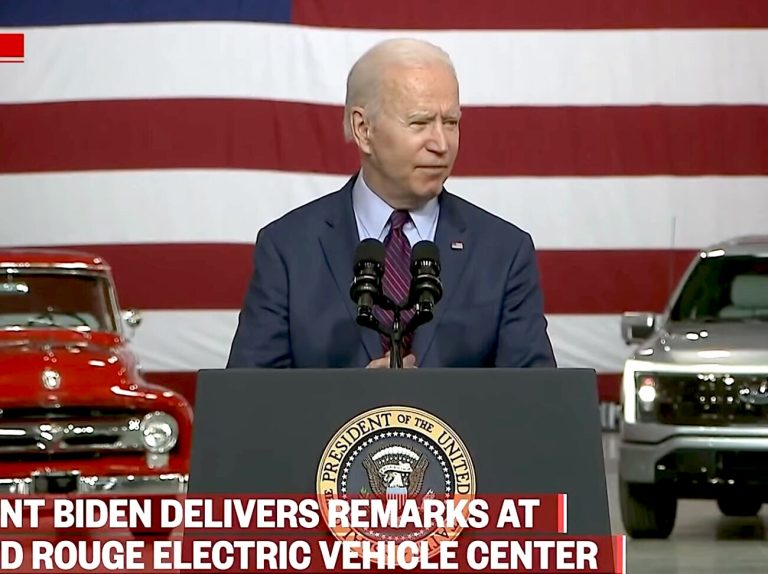

The Biden administration has used hundreds of billions of taxpayer dollars allocated in the Inflation Reduction Act to roll out more green subsidies in recent years.

One of the subsidies is a $7,500 electric vehicle tax credit designed to increase consumer demand for the product.

Read the break from The Daily Caller