context

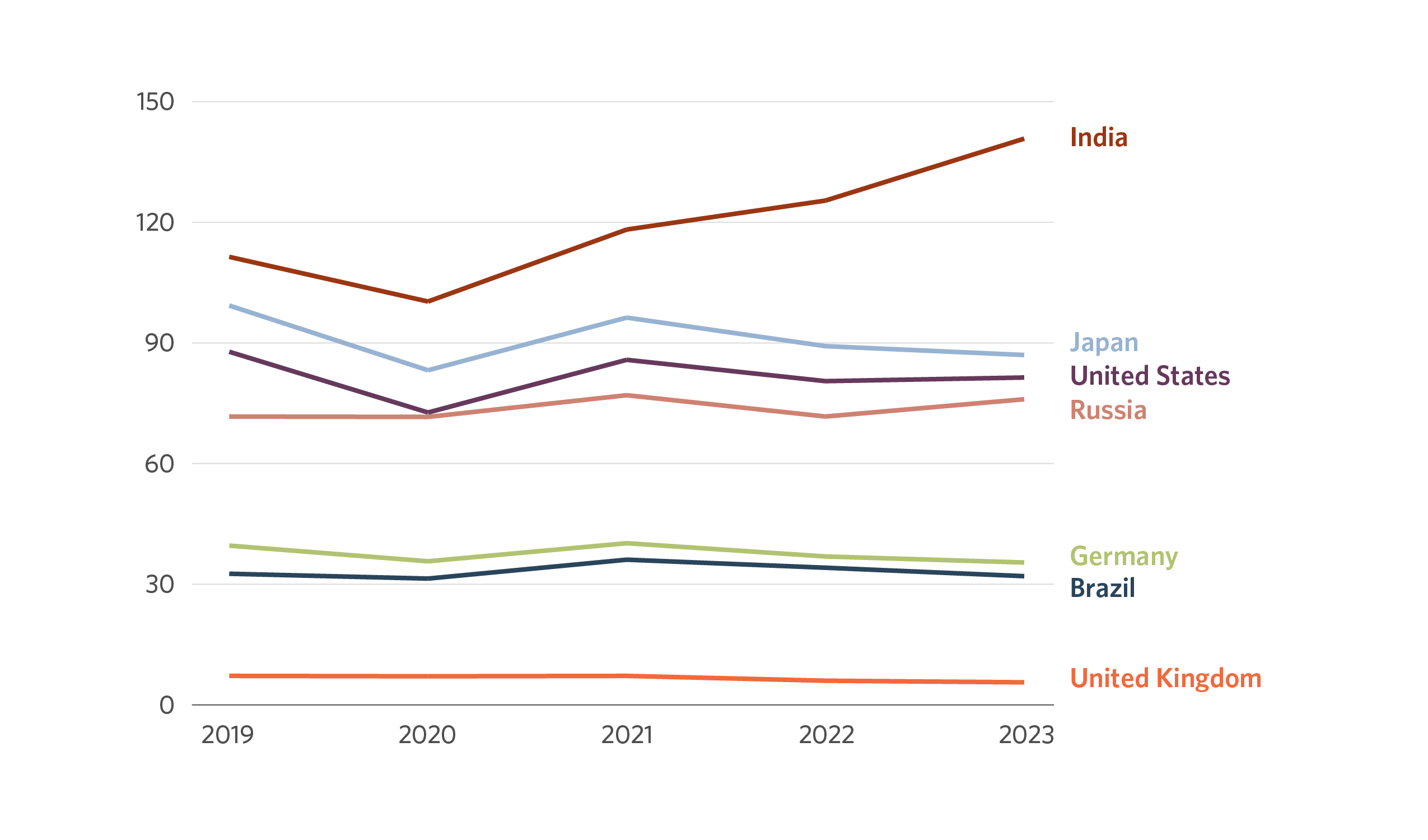

Steel consumption is an important factor in economic growth. Steel is a development industry such as railways, construction, automobiles, etc.[1]. Although steel demand exists in most advanced economies, India has a compound annual growth rate of 4.79%.

Figure 1: Total crude oil production

Source: World Steel Association

The iron and steel industry is a difficult area to accumulate and is India's largest industrial emitter, accounting for about 10-12% of the country's total carbon emissions. Its unobstructed nature stems from two main factors: the dependence on carbon-intensive processes and the complexity of replacing energy based on fossil fuels as feedstock.

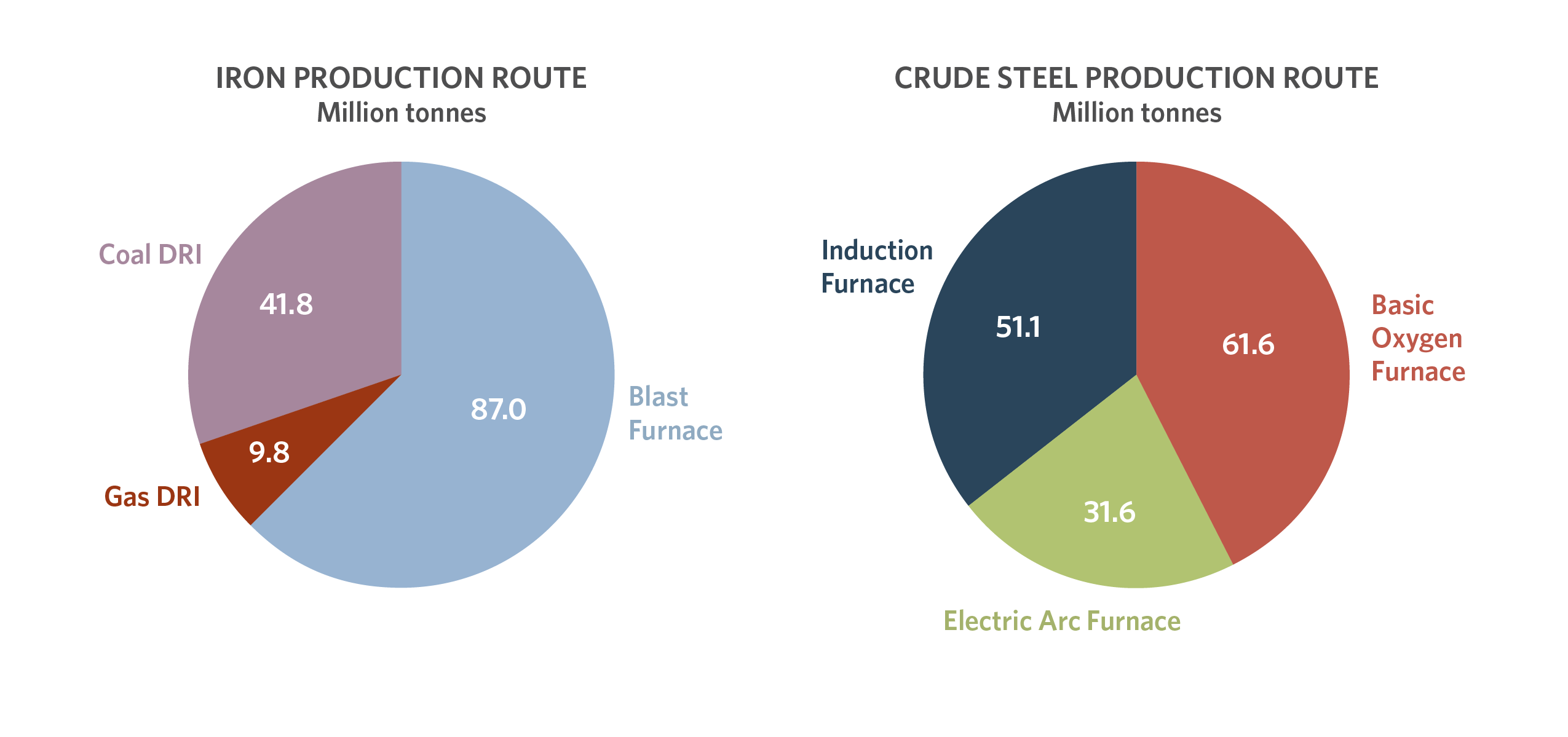

The steel sector in India consists of two parts: the main sector, which includes large integrated steel mills (ISPs) and secondary sectors, including smaller secondary steel producers (SSPs). They have different production routes: the main sectors utilize the explosive furnace-based oxygen furnace (BF-BOF) steel pathway, while the secondary areas rely heavily on direct reduction of ferroelectric arc furnace (DRI-FIRIEF)/direct reduction of iron- Iron-Induction Furnace (DRI-IF) route.

Figure 2: Iron production routes for fiscal years 23-24

Figure 3: Rough steel production route of millions of tons in fiscal 23-24

Source: Ministry of Steel

The barriers to decarbonization of major and secondary sectors vary due to their technological differences and require policy support tailored to their unique needs and challenges.

Industrial sectors like steel may transition gradually, as they usually do not have a financially viable “green alternative”, i.e., they do not have a commercially available pathway that is completely consistent with the Paris Agreement. This hinders their ability to finance green markets through instruments such as green bonds, as they require capital allocation to proven green technologies.

With this in mind, transition financing (TF) is becoming an important financial category that can allow financial flows to “transitional activities” in difficult-to-soak sectors such as steel to “transitional activities.”

Broadly speaking, transitional activities refer to activities that are critical to difficult accumulation and energy-intensive sectors to reduce emissions, but cannot be classified as green because they do not meet environmental standards such as zero or near zero emissions. TF is crucial to the investment in incremental decarbonization leverage of existing BF-BOF plants that gradually reduce emission intensity in the industry, thus paving the way for the slow maturity of zero-emission technologies in the future while ensuring today Gradually reduce the carbon of carbon.

Financial instruments are the key driver of financial flows, and these industries are often locked out of green finance markets because they do not have proven green technology. TF instruments are roughly divided into four parts:

| Musical instrument: | KPI link | use | Hybrid | Traditional |

| example: | Sustainability Loan (SLL), Sustainability Link Bond (SLB) | Transition loans, transition bonds | Sustainability Link Green Bond (SLGB)[2] | Public/Private Equity, Traditional Loan/Bond |

The instruments under the TF umbrella may not be limited to instruments marked as “transition”. We have observed suggestions that any instrument can classify it as a TF instrument if it inspires entity-wide conversion to reduce emission intensity[3]. These may include tools such as sustainability bonds (SLBs) and sustainability-related loans (SLLs).

For instruments marked as “transition,” their capital allocation requirements and fine mechanisms (if any), there is no universally accepted guide. Based on observations of tools issued so far, they can be classified as users without any penalties.

Secondary steel sectors have feasible near-term decarbonization pathways because it uses scrap steel more highly, technically feasible low-emission feedstocks (via natural gas/hydrogen DRI) and electric production processes.

So, the main sectors are better candidates for TFs due to the lack of commercially viable “green” technologies, but there are some technologies that can provide step-by-step emissions today. Capital raised through TF tools can leverage the gradual primary sector transition in two important ways:

- The best available technology integration (bat): The range of bats is adopted in BF-BOF plants is large, thereby improving energy efficiency and recovery. Bats such as crushed coal injection (PCI), cola-drying (CDQ) and maximum pressure recovery turbine (TRT) have reduced negative costs and are therefore economically feasible for carbon dioxide relief. Cumulatively, selected bats can reduce emissions from BF-BOF routes by up to 15% (CPI, 2023[ZF6] ).

- Partial [ZF7] CCU/S-based BF-BOF plants: TF gains can be used to set up a CCU/S unit for BF-BOF-based ISPs that can capture flue gases stacked from the flue, a major contributor to the carbon dioxide emissions of steel production. Despite the high potential for CO2 reduction in this intervention, the technology is not commercially mature and the cost of emission reduction remains unacceptable, with a price of USD 50-60/TCO2 (CPI, 2024). However, due to technological innovation, policy and financing support, and reduced costs in CCU/S unit setup, emission reduction costs are expected to decrease in the coming decades, making this a good candidate for TF. CPI is investigating the potential of converting captured CO2 into value-added downstream products, which can improve the feasibility of this option.

According to tracking data as of 2023, the steel sector in India has a steel production capacity of about 195 MTPA, awaiting financial closure. Two-thirds of the new capacity is expected to be added through the BF-BOF route. If the plants under development have access to TF, they can help them achieve their emission intensity targets/targets by integrating emission reduction techniques in the proposed plants. Thus, by bridging the gap until commercially viable low-carbon technologies emerge, TFs can be critical in achieving a gradual transition to the current and planned plants in the primary sector.

Entity-level transition plans are the cornerstone of industrial transition to lower emissions. Viable, benchmarks and ambitious transition plans are crucial drivers for companies to obtain transition financing. It is crucial to ensure that the transition plan is realistic, avoid superficial or misleading claims and adhere to core transition finance principles. This involves benchmarking recognized standards and best practices and ensuring agreement with science-based goals for zero emissions.

In our work, we have established a framework to follow the guidance provided by the Climate Bond Initiative (CBI), the Organization for Economic Cooperation and Development (OECD) and the Association of Southeast Asian Countries (ASEAS National Association (ASEAS) (Association of East Asians).

Some Indian steel companies have revealed their transition plans. JSW Steel is a leader in this area and we have evaluated their plans based on our framework.

Table 1: Evaluation Framework

| element | guide | JSW Steel Co., Ltd. |

| Net Zero Emission Target | The science-based goal is consistent with the Paris 1.5°C target without exceeding the lower impact, at least well below 2°C. | For the first stage, betting is carried out in terms of energy efficiency, material circulation, renewable energy, operational efficiency, etc. Phase II bets reduce the cost of green hydrogen and CCU/S. Although the Sustainability Report talks about partnerships and opportunities, there is no specific roadmap for adoption or access to funding for technology beyond 2030. |

| Temporary target (segment) | The target year for zero net is 2050. The goals for Phase I and II are derived from the IEA Iron and Steel Technology roadmap published in 2020, which is consistent with the 1.5°C situation. | Long-term transition goals include temporary (short, medium, long-term) quantifiable and time-limited goals. Includes explanations of methodology, assumptions used, and benchmarking. |

| Technical selection | Any science-based approach/roadmap is consistent with the goals of the Paris Agreement. | There is no clear clarity when using offsets. Given that the program shows that emission intensity of 0.996 TCO2/TC in 2050, offset and CCUS will play a crucial role in achieving net zero. |

| Coverage range: Range 1, 2 and 3 | Range 1 and 2 at least. Includes scope 3, where materials and exclusions should be interpreted and demonstrated. | JSW steel will be neutral in all carbon emissions operated under direct control. There is no specific reference to the inclusion or exclusion of Scope III emissions. |

| Use carbon credits and offsets | It should not be used as an alternative to reducing emissions or delaying mitigation measures. Ideally, emission reductions should not exceed 10%. | The financial plan details the meaning of transition, the financing requirements for implementing the transition plan and how such financing can be achieved. |

| Financing | The financial plan details the meaning of transition, the financing requirements for the implementation of transition plans and how such financing can be achieved. | JSW proposes two SLBs related to the 2030 launch intensity reduction target. However, its sustainability report does not map the way to raise or deploy funds after 2030. |

| Avoid carbon locks | Identify existing assets and new investments that may lead to carbon lockdown risks. Develop a strategy and process to be responsible for high-investment assets. | No mention. |

| No obvious damage (dnsh) | Avoid damaging other sustainability goals (e.g., biodiversity) at the activity and entity level. | No mention. |

| Governance | Define the process and responsibilities of regularly monitoring and reporting progress consistent with disclosure standards such as IFRS S1 and S2, timely revisions of goals, and plans for updating. | Governance Framework and Apex's Board of Directors were established. |

| Third-party verification | Third-party credibility verification of transition programs and activities to achieve validity, integrity and performance against benchmarks. | No mention. |

| Just a transitional consideration | Assess and explain adverse environmental and social impacts, including transitions in transition plans for the workforce and communities. Strategies to mitigate this impact will be included in the plan. | No mention. |

Source: CPI Analysis

A reliable transition plan is crucial for steel companies to move it to net net income and ensure transitional financing to accelerate decarbonization. Other Indian steel companies are advised to explore and adopt similar strategies.

This blog is an introduction to the transitional financing efforts in the I&S sector in India. Please stay tuned for the upcoming discussion papers released on February 25Th and a comprehensive report on the topic later this year.

[1] Indian Steel Industry: Growth, Challenges and Digital Destruction

[2] Green Sustainability Link Bonds: Going to the core of accountability and impacting sustainable financing

[3] Transitional Finance: Investigating Game Status – Inventory of Emerging Methods and Financial Instruments