CNBC recently published an article claiming that climate change has the potential to cause the housing market to collapse, with losses of up to $1 trillion. [emphasis, links added]

This is wrong.

Data shows no extreme weather caused by climate change, and The CNBC market is threatened to decline, and the huge increase in housing prices as the planet warms up, indicating strong demand.

CNBC's story, “The U.S. housing market could lose nearly $1.5 trillion in value due to the rising cost of climate change”, is full of speculation but lacks facts about natural disasters and housing market trends.

Diana Olick, who cited the financial company’s claim, said:

According to climate risk company First Street, 84% of all homes in the United States will drop by 2055, with a total loss of $1.47 trillion.

There are about a dozen counties in Texas, Florida and Louisiana that can see half of the home value, the report says.

Dave Burt, founder of investment research and consulting firm Deltaterra Capital, said at least 20% of U.S. homes will be devalued over the next five years by climate change.

As President Obama then-President Rahm Emmanuel suggested, “Never let the crisis be wasted, Olick begins discussing recent horrific wildfires in Los Angeles, not so subtly suggesting that climate change is responsible:

“[t]Now, the losses he has caused from these wildfires seem unimaginable, but in reality they are already part of a calculation that climate risk experts have been modeling recently while trying to measure the impact of climate change on home values. ”

Climate Realism The wrong claim was previously debunked that climate change is the cause of the recent LA wildfires here and here in Los Angeles.

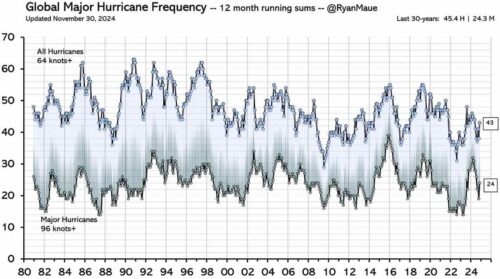

In addition to blaming insurance losses caused by climate change and the sharp rise in insurance premiums in places that have historically been prone to wildfires, CNBC also claims that property on the Atlantic Ocean and Gulf Coast, [particularly in Florida, Louisiana, and Texas where hurricanes are common, and cities along rivers that are historically prone to flooding],,,,, Threatened by a huge decline in property value [due to] Climate change makes extreme weather more common.

Analysts at Deltaterra Capital and First Street claim that insurers are now only derived from the latter factor and have not been held responsible for the risks of climate change.

Several issues in this narrative falsify the link between weather deterioration and climate change, as well as the incidence of extreme weather events, insurance losses and declines in housing value.

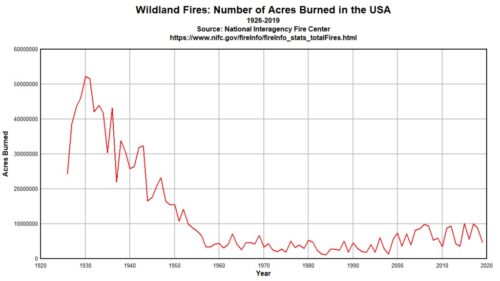

First, it involves extreme weather events, climate Proves contrary to CNBC's recommendation There is no trend toward increasing incidence or severity of wildfires (see chart below), hurricanes (see chart below, Figure 2) or floods.

This is proven by the latest report on climate change (IPCC) on the UN Intergovernmental Panel Wildfires, hurricanes and flood trends have been flat in recent years or have declined in recent years, with no confidence in any trends caused by climate change.

If climate change does not cause measurable deterioration in extreme weather, it is not responsible for increasing insurance losses or declining housing value.

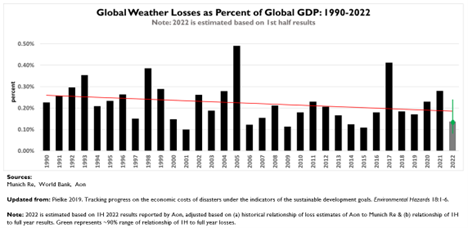

About loss During moderate warming over the past century, the loss of natural disasters has dropped sharply as a percentage of GDP. (See Figure 3 below)

In the scope of insurance losses in recent years, this is due to the increase in insured property in areas prone to natural disasters, as population, housing and operations in these areas have increased dramatically.

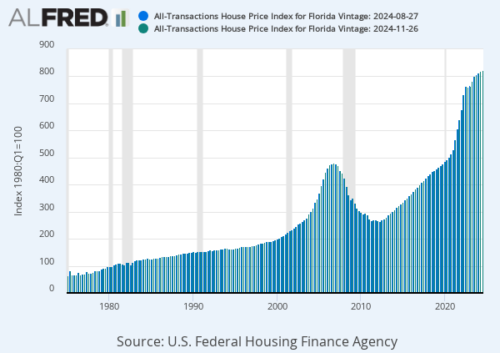

Property value has also increased – weakening the decline in value or desirability of moving to disaster-prone areas [purportedly caused] Through climate change.

As the area where natural disasters expand, the value of property there increases, and when normal natural disaster strikes in history will also increase, the amount of property affected will also increase, resulting in higher losses.

For example, many posts here, here and recently here, discuss the truth about disaster losses in climate realism.

In fact, in recent years, the property value of First Street and Deltaterra has been relatively stable and significantly increased in the limitations of rapid decline.

It seems that floods, hurricanes and wildfires (oh, mine!) are dissuading few people to move to or rebuild in areas that are prone to occur. (See Florida picture below, for example).

CNBC should perhaps consider the source of housing decline claims that it is disguising before it regards its easily debunked assertion as a gospel fact.

For both companies, if climate change is not a disaster or risk, their business models will collapse, and so will their existence be the reason.

Neither First Street nor Deltaterra are typical financial analysts or service companies that make money when their clients make money, but when they induce investors to sign with them specifically for climate forecasts, they make money.

For example, First Street clearly states “We exist Establish a connection Between financial risk in financial institutions, companies and governments on climate change and scale. ” (emphasized mine).

Not sure if there is such a link or a comprehensive examination of whether there is any such link between climate change and financial risks, but to what extent it is to create a link.

They are determined to show this connection.

Deltaterra is equally biased, describing itself as: “an investment research and consulting company Provide institutional investors and other real estate capital market participants with the tools they need to measure and manage financial risks associated with climate change.transparent

For both companies, if climate change is not a disaster or risk, their business models will collapse, and so will their existence be the reason.

The media's ongoing knowledge of climate disaster claims is what makes these companies engaged in business activities. Real-world data clearly undermines the need for research and advice they provide.

Smart investors will avoid the Charatians claiming that climate change is hurting their development and business prospects and their portfolios. It is a fact that honest journalists will stop promoting climate disaster narratives.

There are enough practical hazards and risks in the world to provide feed for mainstream media reports without continually promoting the Phantom climate change disaster narrative.

Furthermore, economic, fiscal, geopolitical and yes, weather-related events have enough practical risks for investors to pay attention to without fear of climate risks without evidence and are unlikely to make recommendations based on difficult data. The actual impact of climate change may be the real impact.

Chandler Cruttenden on Unsplash by Chandler Cruttenden

Read more in Climate Realism