People from Manhattan against the trend

Francis Menton

JP Morgan Chase – This is the largest bank in the country. Celebrity CEO Jamie Dimon has led it for nearly 20 years. For most of the 20 years, Chase and Dimon are known for their awakening orthodoxy, at least in their official statements. For example, this is the October 2020 work of Forbes, citing Dimon's theme on “systemic racism.” (Pithy Quote: “Systemic racism is a tragic part of American history. . . . Long time ago, society addressed racial inequality in a more meaningful, meaningful way. ”)

Awakening the orthodox faithfulness to the past, especially to the theme of “climate change.” In April 2021, JPM released a major announced plan to promote investment of approximately $2.5 trillion “Climate action and sustainable development.” In October 2021, JPM joined the so-called Net Zero Banking Alliance, which was then organized by the United Nations (led by Mark Carney) and promised to starve the fossil fuels of investment capital to reduce carbon dioxide emissions.

But at the same time, on JP Morgan Asset & Wealth Management, they have a guy named Michael Cembalest, who currently has the chairman of Marketing and Investment Strategy. For about 15 years, Cembalest has released an annual report called the “Annual Energy Document.” I've covered several previous reports from Cembalest, previously in 2021, here for 2022. Both posts have the titles of “Fantasy and Reality in Woke-Land”. Cembalest just used the 2025 edition of the annual energy file, so it is considered to be the third part of this series.

These reports from Cembalest are far from perfect. On a basic level, the report accepts the idea that a real energy transition is underway, that it is important in some way and that the use of fossil fuels must be eliminated eventually. I don't know if Cembalest really believes these things, or if accepting them for your public reporting purposes is the price of having a high-paying job at JPM. Either way, while I think the failure to question these ideas is a major flaw in these reports, failure does not prevent the most serious and realistic view of many aspects of the so-called energy transition that is completely failed.

I will start with several parts of this year's report, which I think is the strongest: a report covering hydrogen and carbon capture and storage (CCS).

hydrogen

Starting from page 45, the partial title of Cembalest on hydrogen is “Frying: Cancel the Green Hydrogen Project in Sunlight Exposed to Energy Mathematics.” Reasons for using the word “Fry”: “[M]Since energy math doesn't work, any hydrogen project is fried (terminated). ”

Cembalest quotes Hanns Neubert in June 2024 German, Technical Review:

“The non-existent electrolyte should use the non-existent residual electricity to transport hydrogen into a non-existent network to operate a non-existent power plant. Or, transport hydrogen from the supply country through a non-existent ship and port, and transport hydrogen from the supply country – you guess – you guess – you guess – you don't.”

There are about 12 unsurpassed obstacles in the way of the green hydrogen economy. My favorite:

Although taxpayer subsidies promote supply, a green hydrogen economy has little to nowhere. For example, in the United States: The $3 per kilogram of production tax credit is equivalent to $91 per kph (i.e., $30 to $50 per kph in 2024).

(Note that the $91/MWH tax credit for green hydrogen is just the subsidized portion of the cost of manufacturing fuel; the wholesale cost of $30-50/MWH includes all the elements of power generation, not just fuel).

CCS

In the CCS section of page 19 of the report, Cembalest correctly notes the fact that after decades of hype, CCS absolutely has nowhere to go. He called CCS “citations and usage rates” (i.e., the number of citations in academic papers divided by the actual operational capabilities of the CCS facility) “The highest proportion in the history of science.” The chart shows the current capacity of operating CCS facilities in the United States, accounting for approximately 0.1% of CO2 emissions. If all planned facilities are actually built (very unlikely based on experience), the percentage of emissions captured will reach 0.8% of emissions.

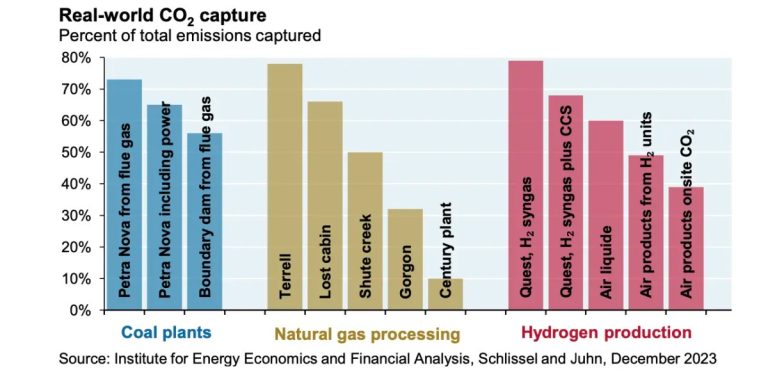

Another interesting chart shows that while most of the energy production of plants consumes a lot of energy production, the built CCS facilities are far from all CO2 emissions from the relevant plants. Here is a part of the chart:

Capturing 55-75% of coal power plant emissions will never satisfy environmental fanatics. So what's the point?

OK, these are the strongest majority of reports. Let's explore the fundamental flaws.

Solar energy

The biggest theme of this year's report is “Heliecentrism”. The title of the executive summary of the report is “Thermal-centrism and the speed of energy transition.” Why the word “Helipentrism”? “For the purposes of this article, Heliocentrism refers to the rapid growth of solar and energy storage at the heart of the energy transition and no longer requires new investment in complementary thermal power generation.”

Cembalest said there were obviously many “believers gecentricism” and proposed cases for them:

Believers’ believers about geocentrism show that the rapid growth of global solar energy has more than doubled in the past three years. If BNEF’s prediction is correct, solar energy will double again from 2024 to 2027. Solar energy is now the main form of global capacity increase, accounting for 60% of new capacity in 2024, and according to our estimates, the 2027 estimate is about 75%. According to Carbon Shief, the IEA has grown solar energy for many years over the years and has tried to catch up to the following, according to Carbon Shief. Globally, the combination of wind and solar power has surpassed nuclear power and should surpass hydropower by 2025.

The cemetery pointed out “There are a few 'but' to keep in mind.” That's gentle! As “Buts,” Cembalest mentioned that the annual capacity factor of solar facilities is in the range of 15-20%, and the generation of electricity from solar panels does not solve the energy use problems for non-electric purposes such as transportation, industrial and most space heating. fair enough. But he never had the biggest problem because it was dealing with intermittent problems when the penetration of solar power in the grid increased.

The issue of energy storage is hardly mentioned. This is on page 5:

I talked to EIA analysts and quoted the “amazing” battery storage: between 2027 and 2027, before 22.5 GW, another 38 gw. This suggests that certain gas peaks and basic loading plants may eventually be displaced.

Well, how “amazing” that is? Convincingly, Cembalest doesn't even use the right units to describe the battery capacity (they are watt hours instead of watts). But, let's say we're talking about a standard 4-hour lithium-ion battery. Simple arithmetic for a few minutes shows that this “stunning” amount of storage is a small part of what you need to back up the main solar grid. The United States used 4,086 TWH or 4,086,000 GWH of electricity in 2024. Except for 8760 (hours of the year), it is 466 GWH per hour. The 38 + 22.5 GW battery totals 60.5 GW, with a storage time of 242 gwh for a duration of 4 hours. So, about half an hour worth. A full backup of the main solar grid will require approximately 500 to 1000 hours of storage space. So the “amazing” 242 GWH is about 0.05% – 0.1% of the storage space required. Almost meaningless quantity.

Cembalest concluded that despite the rapid increase in solar power generation, it only increases in “linear linearity”, which is not fast enough to surpass all fossil fuel production in any short time. therefore, “[A]SA general principles. . . The United States and Europe no longer need base load and backup heat capacity. ”

OK, sorry Mike, but you missed the big picture. If you have done the arithmetic, it's easy to see that solar power supplying the grid without a thermal backup is not only “a long way to go”. Solar energy is no way It will become the main source of advanced economies. You owe customers, telling them that this doesn't work and there is a green wall of energy. But you failed.

Meanwhile, there are at least some reasons to believe that the highest level of JPM is finally beginning to see reality and rethink its green energy commitments. Just in January, JPM withdrew from the Net Zero Banking Alliance. Perhaps by the time next year's report approaches, the bondage will be taken away from Mr. Cembalest, who can give readers a certain truth.

Related

Discover more from Watt?

Subscribe to send the latest posts to your email.