For someone whose opponent might tag him an annoying windbag, Ed Miliband is unfortunately unable to stop his green energy revolution from being nearly blown up. [emphasis, links added]

Of course, he wasn't saying he had anything.

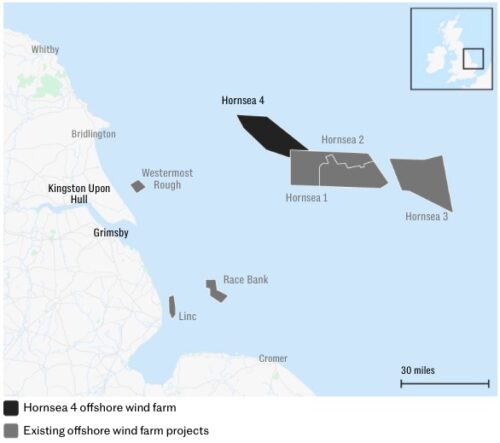

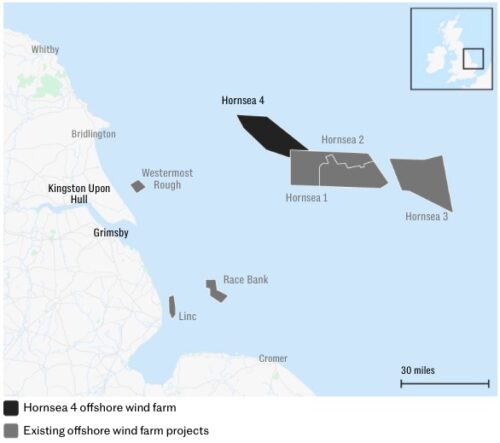

Listen to the Minister of Energy’s response to Danish renewable energy giant Ørsted pulling out the plug of the Hornsea 4 wind farm on the Yorkshire coast, you might be wondering if the announcement was lost on his way to the energy sector.

“We are still committed to working with Ørsted in a bid to get Hornsea 4 to happen until 2030,” Miliband told reporters during a visit to Norway.

Sadly for the Minister of Energy “The computer says there is no '' method won't go away.

If it risked destroying his green mission, it was never to deal with the fact that it was inconvenient Miliband must now explain what this means for the government's plan to quadruple the UK's offshore wind by the end of this decade.

More importantly, if the wind is no longer relied on to contribute as much as possible, the country has the right to know what the plan B is.

Will mini nuclear weapons become an important part of a larger combination? If so, are they as reliable as supporters?

Should interconnectors become more common?

Or does it mean that more towers have been carpeted countryside and ruined the lives of those unfortunate people as they find themselves living in the shadow of these clumsy structures?

These are the tricky questions the cabinet needs to quickly find out the answers after Ørsted decided to abandon this plan.

The harsh reality is that it's bad for Miliband, who is now at risk of seeing his big net zero vision evaporate before his eyes.

This is not just one of the largest clean energy projects in the UK, it is the most important wind farm built in British waters.

For a government that pushes most renewable energy toward wind, the storage of a project of this size is nothing more than a disaster.

The Hornsea 4 will be big. It extends to 180 giant turbines, promising 2.4 GW (GW) of power, which is enough to accommodate 2.6 million homes when the wind blows – a very important warning that the blink of an eye-catching green champion tends to ignore when lobbying more of these huge installations.

The Hornsea 4 is so big that preachers think they bagged half of the 5GW of offshore wind projects in the last renewable auction round in 2024.

Miliband may question such a serious assessment. After all, removing 2.4GW of power from the mixture is undoubtedly a blow, but by 2030 the target capacity is 43GW to 50GW, one might say it represents a dent rather than a slit hole.

After all, the UK has 16GW of offshore wind power, and another 28.6GW is under construction or will be built.

However, ministers now have to face the possible knock-knock effect of Ørsted's withdrawal.

If the world's outstanding offshore wind experts think these numbers are no longer stacked, what are the possibilities for other planned projects to survive?

Unless Miliband is ready to force taxpayers to further subsidize the wind industry, the chances of a string of other dust bites are obviously only shortened.

Ørsted's boss Rasmus Errboe sounds almost nothing more bearish. He said the Hornsea 4 project has suffered “several adverse developments” since the company won the contract.

Given that it was September 2024, this is a huge change in the situation ØRSTED blames rising supply chain costs, higher interest rates and “increased risks of building and operating Hornsea 4 projects of that size on a planned schedule.”

Equally worrying, the company also warns of an increase in “execution risks”, suggesting it underestimates the difficulty of installing 180 giant turbines. It would be a miracle if other developers at least haven't reevaluated their plans.

Of course, Ørsted overpaid and is now suffering from buyer rebroken possibilities, especially since it was the only party that successful bidders won the cold foot last year.

But with the company preparing to pay a “classified” cost of €563 million ($563 million), perhaps the economics of offshore winds no longer make sense.

This is not right when the Department of Energy Security and Netcom acknowledge “the impact of global inflation and supply chain pressure on offshore wind projects.”

But such admissions have made ministers and families omnipotent, and developers almost certainly demand more subsidies in the subsequent offshore wind auctions later this year.

Such a result will push Miliband's already doubted commitment to lower customer bills into the realm of faith.

Read on the Telegram Break