CNN's Andrew Freedman, in a recent post titled “Why climate risk affects the credit score of your home you buy”, described a new report from FirstStreet that claims to indicate how “climate risk” affects credit scores and mortgages due to the alleged increase in the frequency and severity of weather forecast mortgage mortgages. [emphasis, links added]

This narrative is highly misleading, if not completely wrong.

Claiming climate risk is a new and emerging driver of credit risk ignores basic climate and economic reality – i.e., extreme weather has not become more common or severe.

Furthermore, the surge in insurance claims in coastal areas is driven by population density, development and property value upgrading rather than increasing climate change.

CNN and FirstStreet proposed the concept of “climate risk” as quantifiable independent factors that can be measured and predicted, just like credit scores or debt-to-income ratios.

However, “climate risk” is a vague term and has not been scientifically proven or even clearly defined. It confuses weather events with long-term climate trends.

The weather is direct, measurable and historically recorded – hurricanes, floods, tornadoes.

On the other hand, the climate is the statistical average of these events over 30 years or more. The term “climate risk” is a misleading invention designed to imply that weather events are becoming increasingly serious or frequent despite the lack of supporting data.

Data on severe weather events that caused the greatest damage does not support Firststreet or CNN's claims about rising costs driven by climate change.

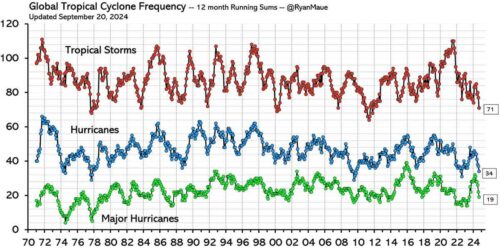

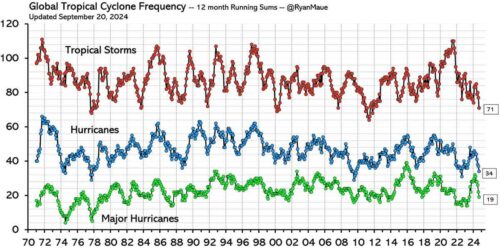

Hurricane frequency and intensity:

Flood frequency and severity:

- According to NOAA's database of billion-dollar weather and climate disasters, The frequency of flood events did not increase after adjusting for population and property value growth. The main drivers of increasing flood-related insurance claims are Expansion of high-value properties developed or expanded in historically flood-prone areas.

- Detailed storm and flood event data in NOAA's storm event database clearly demonstrates The significant increase in flood-related damage is largely due to the increased concentration of assets in fragile coastal areas.

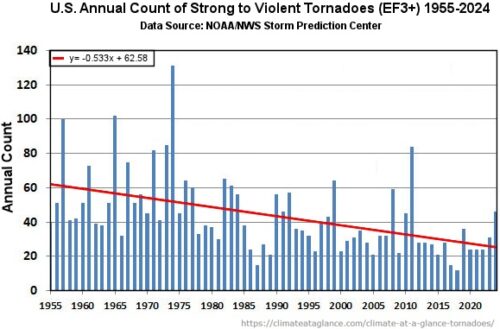

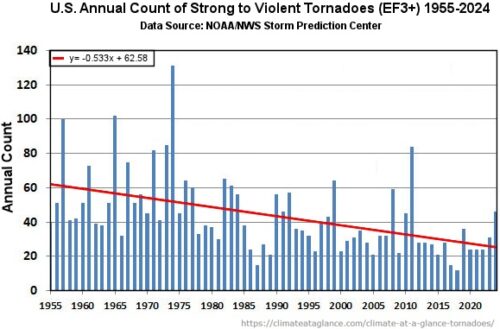

Tornado Frequency and Intensity:

- As shown in Figure 2 below, NOAA's Storm Prediction Center (SPC) data proves that The trend of frequency and intensity of strong tornadoes declines (EF-3 and above) In recent decades. The slight increase in reported weak tornadoes is mainly due to improved detection techniques rather than the actual increase in tornado frequency.

The increase in the total number of weather-related insurance claims reported in the NOAA storm event database is directly attributed to the increase in more people and higher value and higher value properties in disaster-stricken areas such as Florida, Texas, and California, rather than increasing the number or intensity of weather events.

When adjusted for inflation and population growth, the increase in insurance losses that should be driven by climate disappears.

Why does FirstStreet inaccurately describe the losses driven by complex weather by economic development as a result of climate risks? The answer lies in its target audience: financial institutions, mortgage lenders and insurers pushing ESG standards and seeking reasons for high premiums and stricter lending standards.

FirstStreet’s report titled “Climate, Sixth Credit,” climate-driven credit risk is an emerging financial threat that mortgage lenders are expected to face By 2025, annual losses are US$1.2 billionrise to $5.4 billion by 2035 Due to extreme weather events.

However, this prediction relies on modeling future speculation, rather than hard data that reflects actual trends.

It does not state the fact that insurance claims are naturally higher in areas with high population growth and real estate inflation, especially in coastal areas where waterfront properties are one of the most expensive and popular states in the country.

Firststreet's report even acknowledges Areas with the highest collateral redemption rate Quickly appreciate property value and high densityespecially in coastal areas that expand to coastal areas that have historically prone to flooding.

Climate change has nothing to do with these losses and foreclosures.

The report cites Hurricane Sandy (2012) as a classic example of “hidden credit losses” related to climate impacts, claiming that lenders underestimated $68 million in loan defaults due to flooding outside the FEMA flood zone.

However, it overlooks the mention that Sandy hits as the value of property on coastal New Jersey and New York coastal areas soars. So the real estate bubble, not the hurricane, is the main driver of foreclosure losses, so there is no climate risk signal here.

The FirstStreet report is not a real risk assessment related to long-term climate trends, rather than a marketing tool that aims to promote its proprietary “climate risk” data products developed and hopes to sell to financial institutions.

By creating a new credit “C” “Climate” – the company positioned itself as an essential analyst and broker for the continued monetization of climate in the financial sector.

Why does CNN's Freedman not critically promote Firststreet's suspicious narrative? Perhaps, due to alarmers’ headline clicks and the sensational claim to “climate risk” is more attractive than the mundane truth, as coastal real estate is overpriced and overbuilt.

The “climate risk” of the erroneous siege allows regulators, insurers and lenders to justify higher premiums, interest rates and stricter credit standards while shifting attention to the actual reasons for rising mortgage costs, premiums and claims.

And, by failing to review Firststreet’s “Capital Sixth C Climate” report, Freedman and CNN act more like journalists at the climate industry complex than journalists who discover and introduce truth.

Undefined “climate risk” is not the real threat in this story. Instead, the real threat is the financialization of fear and the desire for the signal of virtue, while using speculative climate models to make abundant profits for climate change to justify predatory lending and insurance practices.

Read more in Climate Realism