On Thursday (May 22), the House passed a narrow profit of 215-214, the so-called “big and beautiful Bill” [BBB]” – A compilation of large-scale tax and expenditure measures that can now attempt to avoid controversy in the Senate on the grounds of “budget settlement.” [emphasis, links added]

BBB is over a thousand pages in length (get the full text here) and covers many topics.

Most of the BBB summary I see never receive important subsidies for so-called “green” energy – wind turbines, solar arrays, grid-scale batteries, hydrogen production, etc.

This is understandable given the large number of important issues covered in the bill. However, green energy subsidies are a huge problem.

They consist of generous tax credits for long-standing wind and solar facilities, as well as a range of subsidies and handouts created by the so-called inflation reduction bill of 2022.

In an article I wrote when I enacted the IRA, I was associated with an analysis that estimated that the green energy handouts for IRA alone were about $370 billion (though I pointed out that the handouts for IRAs are uncollections and may end up far beyond that).

Since wind and solar generators can never make meaningful contributions to the grid, tens of billions of dollars of subsidies are heavy losses to the economy and people.

Getting rid of them needs to be a top priority in the Republican Congress.

However, there are serious doubts about whether Republicans can call for political will to cancel them. So, I think I'll look at the bills and see how they are treated.

To my surprise, the BBB passed through the house and seemed to abolish and abolish all the green energy handouts from the IRA.

The IRA has added a series of new sections to the Clean Air Act to create a variety of large amounts of funds for the “reducing greenhouse gases” efforts.

Go to Section 42101, etc. BBB (You need to scroll down to get there the long way to go down), you will find These handouts will be abolished. excerpt:

SEC. 42101. REPEAL AND RESCISSION RELATING TO CLEAN HEAVY-DUTY

VEHICLES.

(a) Repeal.--Section 132 of the Clean Air Act (42 U.S.C. 7432) is

repealed.

(b) Rescission.--The unobligated balance of any amounts made

available under section 132 of the Clean Air Act (42 U.S.C. 7432) (as

in effect on the day before the date of enactment of this Act) is

rescinded.

SEC. 42102. REPEAL AND RESCISSION RELATING TO GRANTS TO REDUCE AIR

POLLUTION AT PORTS.

(a) Repeal.--Section 133 of the Clean Air Act (42 U.S.C. 7433) is

repealed.

(b) Rescission.--The unobligated balance of any amounts made

available under section 133 of the Clean Air Act (42 U.S.C. 7433) (as

in effect on the day before the date of enactment of this Act) is

rescinded. . . . The bill continues in the following section, with the continuous parts with the “Greenhouse Gas Reduction Fund”, the “Low Emissions Electricity” program, which is the fund to address “School Air Pollution”, which is the fund to reduce diesel emissions.

How much real money does these things add up in general? This is a very difficult number to grasp.

As mentioned above, the IRA's green energy handout totaled $370 billion at the time of its passage.

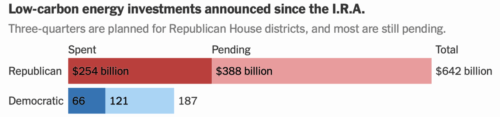

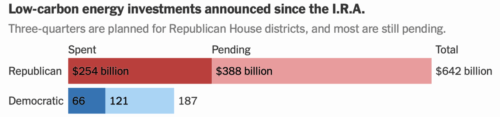

But in the New York Times on Thursday, May 22, we found a chart with a much larger estimate than the BBB's estimate:

According to the chart, since the IRA, the government has announced about $829 billion in “low-carbon energy investment”, of which $3.220 billion has been spent, while $529 billion is still “pending”.

So if the BBB is achieved through the Senate, it will eliminate more than $500 billion in wasted green energy spending.

Then there is a separate issue of tax credits for producing electricity using wind and solar energy. These things have been around for a long time – the so-called “investment tax credit” of solar and wind since 1978, and the “production tax credit” of wind tax since 1992.

The BBB will receive credits from the 60-day deadline after the issuance of the bill to begin construction of any project eligibility, as well as the deadline for completing any such project in 2028.

Believe it or not, these deadlines may mean that these tax credits will be effective and end immediately unless already qualified for the project.

This is quoted from the May 22 Utility Diving website, citing the analysis of investment bank Jefferies:

The bill terminates the 48E investment and the 45-year-old production tax credit for non-nuclear clean energy projects that will be put into use after 2028 without phases. Projects must start construction within 60 days of the bill’s creation, which may be eligible for credit later this year. . . . [T]Jefferies said he cut off the qualification window, providing non-nuclear developers with a “nearly impossible” path to qualifying for credits at 48E and 45 years old.

At Reuters, we find the potential end of the green energy boom and its lament for all the endless gains of the people. For example, Reuters quoted Abigail Ross Harper from the Solar Industry Association:

“If Congress does not change the curriculum, this legislation will upend the country’s economic boom, which has already offered a historic U.S. manufacturing revival, lower electricity bills, thousands of high-paying jobs, and states that mainly voted for President Trump.”

Well, Abigail, what kind of “prosperity” will only occur if there are tens of billions of dollars of government funds to support it, and disappear immediately when the handout is withdrawn?

This prosperity is a huge destruction of wealth that needs to end as soon as possible.

Read more among Manhattan counter-trends