Cities are on the frontline of the climate crisis. Despite the growing demand for urban adaptation, funding is still shocking. Hamza Abdullah and Alastair Mayes from CCFLA reveal why financials are not flowing and what can be done to close the gap.

Cities are still underadapted, especially in the global south.

The Urban Climate Financial Leadership Alliance (CCFLA) is a coalition of more than 80 public and private institutions designed to narrow the urban climate financial gap. We do this by building practical knowledge, fostering collaboration and conducting policy discussions on key topics, such as adaptation financing, project preparation, private capital and public finance.

Since 2019, CCFLA has delivered over 40 knowledge products, including the flagship Urban Climate Finance Report (SCCFR), and has convened more than 120 global events. Our initiatives, such as Project Preparation Facilities Connectors (PPF Connectors) and quarterly action teams, help members expand urban climate investments and drive real-world solutions.

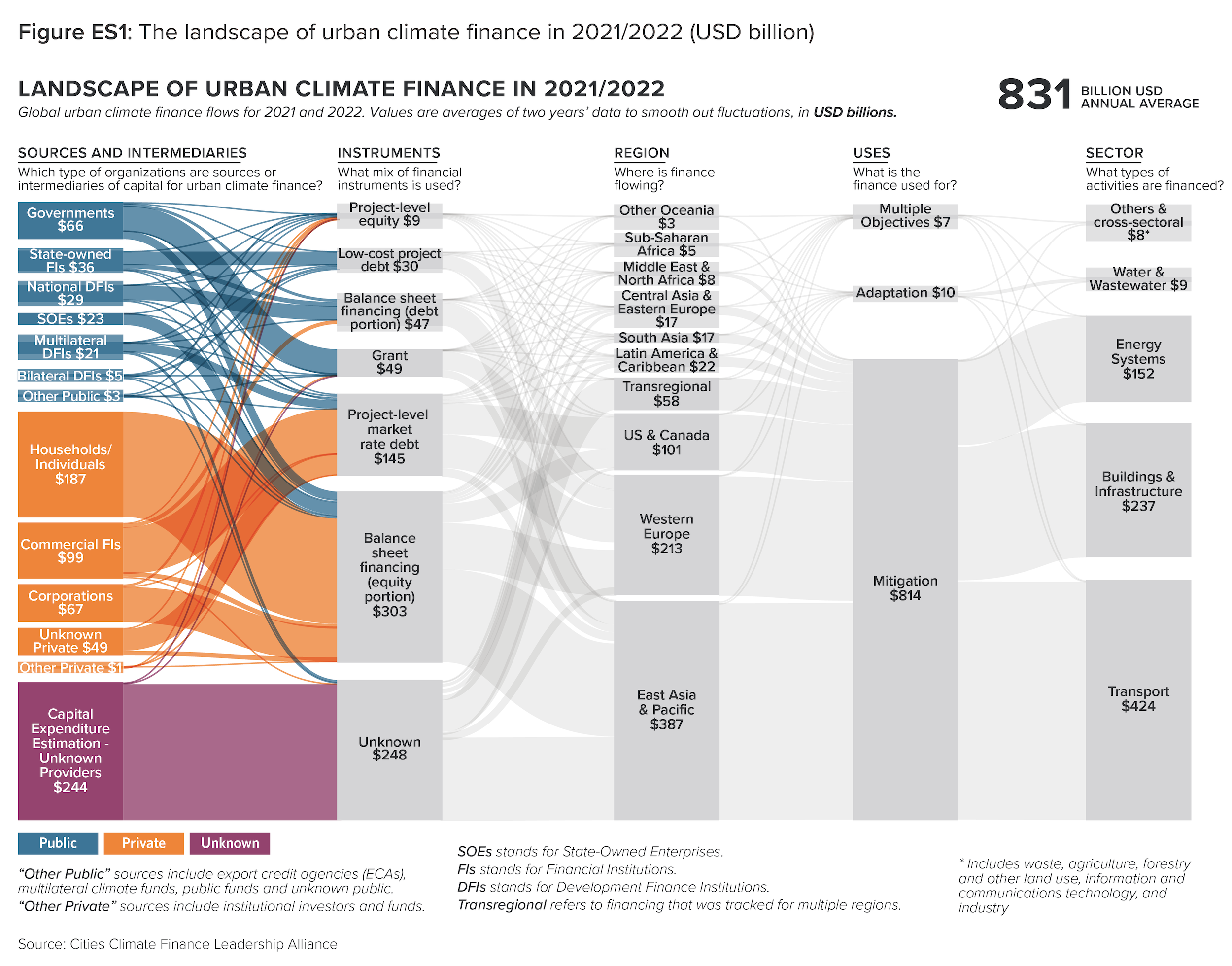

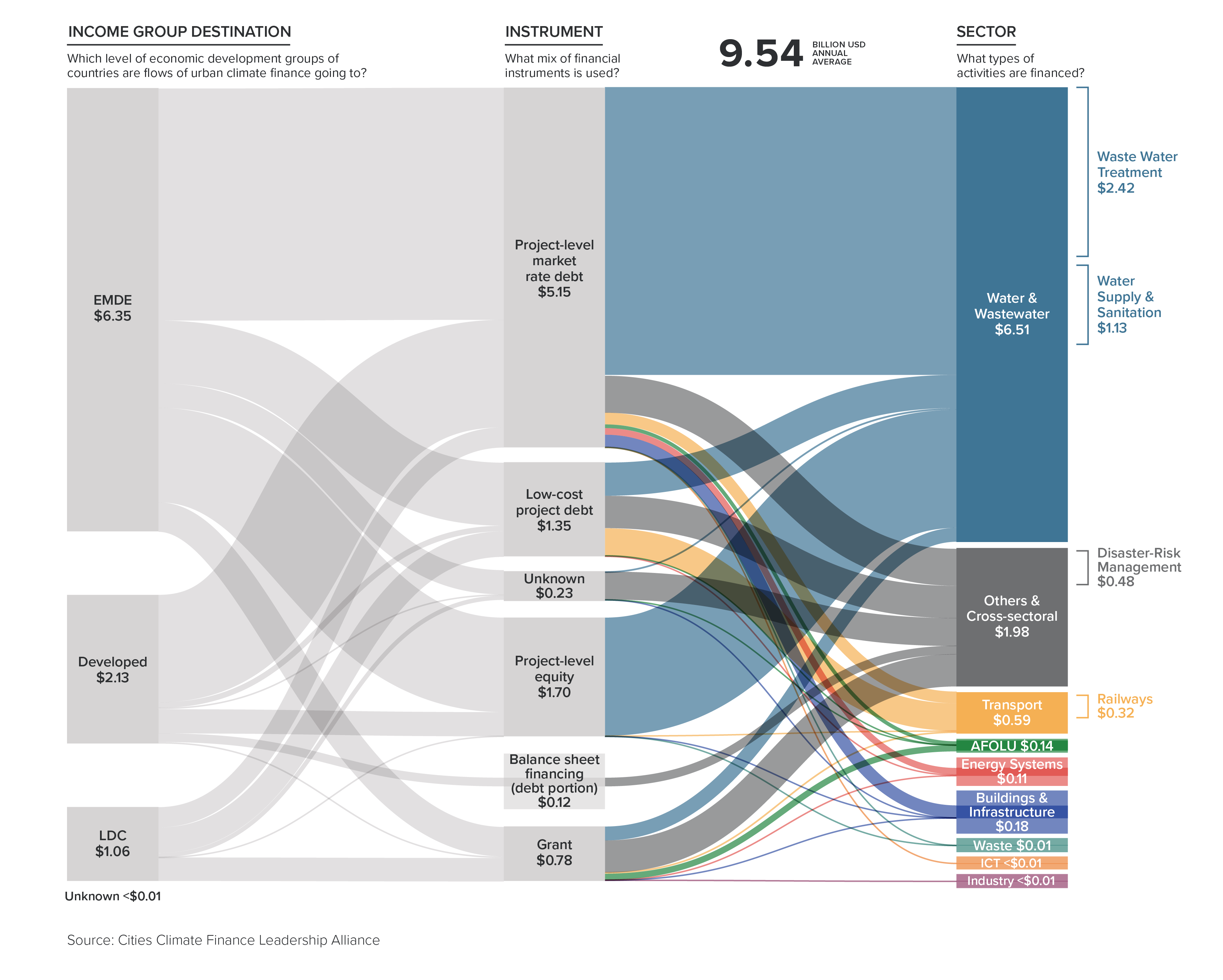

According to SCCFR, $831 billion is directed to urban climate projects in 2021 and 2022. However, adaptation projects received only $10 billion, with only $6 billion of which is spent on cities in emerging markets and developing economies (EMDES). Sub-Saharan African and South Asian cities gain only 8% and 7% respectively.

However, Emde Cities will need $147 billion in adaptability per year by 2030, and more may be needed given the ongoing data and tracking gap.

Why are cities under-adapting financing?

Adaptive financing is difficult to obtain at the urban level, especially in the global south. Here are six reasons:

- The national climate agenda often ignores urban demand. When prioritizing funds, this makes the city adaptable to sight and thinking.

- Multi-layered coordination gaps, policy errors, and legal and financial restrictions leave cities without clear powers or incentives to fund and implement adaptation measures such as flood control or cooling infrastructure.

- Cities lack the professional ability to adapt, including the risk assessment tools and investment frameworks required to prepare adaptation projects that meet financiers’ standards.

- Urban-level adaptation projects are usually small and belong to the standard lending standards for multilateral/national development financiers.

- The city government has a poor reputation, a poor market environment, and a lack of business models adapted to the project further investors. This makes cities rely on scarce income from their own resources as well as unpredictable transfers or grants.

- Due to unbearable premiums or complex spending procedures, cities rarely use insurance to transfer climate risks, ultimately preventing financiers from supporting climate smart investments.

Promising mechanisms to fund urban adaptation

Despite these challenges, perceptions of adaptation and resilience are changing as more and more awareness of these investment opportunities is growing. Several promising mechanisms are emerging to promote adaptive and resilient private investment. Cities can adopt many such mechanisms to attract financing for their projects.

For example, Escape mechanism It is crucial to unlock adaptive and resilience of private capital. The most promising one is Mixed Finance Mechanisms that pay for public and private finance, such as the $500 million World Bank local risk guarantee, can unlock $900 million in commercial loans in the city of Lourland, Angola for resilient water infrastructure.

also, Parameter insurance Products show hope in unlocking rapid post-disaster financing in cities, and when merged in a merger system like the Philippines’ urban disaster insurance pool. This can allocate costs and risks and facilitate access to additional revenue streams for cities to build resilience.

Due to low credibility and small project size, many cities at EMDE have difficulty obtaining private investment in urban adaptation and resilience projects. To address these challenges, improving municipal revenue is crucial. Land value captureCharging developers with positive growth in land value can unlock revenue from adapting to plans. farther, Summary procurementthrough multiple cities, the needs can be aggregated, can be solved by solving the challenges of small-scale projects and helping cities purchase products and services at affordable prices. An example is the RAMCC Trust, in which 30 Argentine municipalities purchased climate-smart technology for a lower price.

and, Payment for ecosystem services It can inspire environmental protection. A successful example is in Freetown, Sierra Leone, where the Treetown Project of the Treetown project pays residents to maintain trees and sells carbon credits to fund further afforestation.

What can a city do?

Cities can leverage these mechanisms to expand adaptation investment by focusing on four key drivers of CCFLA regulations, part of it 4CS Agenda Accelerate urban climate finance:

- promise: Integrate adaptation goals into local climate plans and advocate for their inclusion in nationally determined contributions (NDC), national action plans (NAPS) and national investment platforms.

- cooperate: Tag adaptation projects are consistent with international taxonomy to express resilience results to private investors and work with national governments to improve the enabling environment, leverage the CCFLA’s favorable framework conditional tool.

- capacity: Establish a dedicated adaptation sector to share climate risk data with the private sector, leverage programs such as Global Risk and Resilience Scholarships and Urbanshift City Academy; and click Project Preparation Facilities (PPFS) using CCFLA's PPF Connector.

- Capital mobilization: Use guidance from tools such as City Cred Tool to improve credibility and interact with development finance institutions, climate funds and PPFs to leverage the innovative financial mechanisms discussed above.

The Paris Agreement global stocks highlight the end window to avoid an opportunity to overshoot temperatures. It noted that urgent action is needed to increase adaptation financing in urban areas, especially in the rapidly urbanized global South, where climate change will complicate economic risks and human suffering. Close the financing gap in cities across the globe is both a fair and smart economic issue: Latest evidence from the World Resources Institute (WRI) shows that every dollar used to adapt can generate more than $10.50 in benefits.

cITIEs in the Global South must have the ability to adapt to climate change. National and multilateral policy makers should quickly expand adaptation financing, reform their mandates to enable direct access to financing in cities, incentivize private investment and invest in building local capacity. At the same time, cities must integrate climate into their budgets and explore innovative financial mechanisms to invest in climate smart infrastructure to protect their people and economies. Now is the time to act.