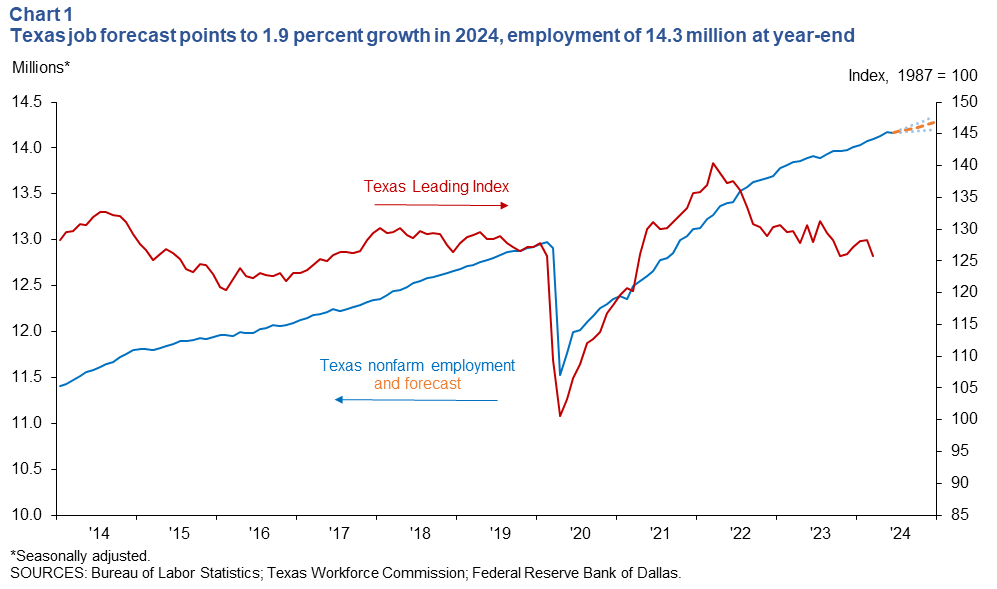

The Texas Employment Forecast predicts job opportunities will grow by 1.9% in 2024, with an 80% confidence interval of 1.4% to 2.4%. The forecast is based on an average of four models, including projected gross domestic product, oil futures prices and the Texas and U.S. Leading Indexes. Forecasts show the state will add 266,100 new jobs this year, with the number of people employed in December 2024 reaching 14.3 million (figure 1). Growth for the rest of the year is expected to be 1.5%.

Texas employment fell slightly at an annual rate of 0.2% in June, following an upwardly revised 3.2% increase in May.

“Texas employment fell slightly in June due to job losses in the service sector, with the state losing about 1,900 jobs. This offset strong employment growth in the goods-producing sector, led by a sharp increase in construction employment,” said Senior Federal Reserve Bank of Dallas said business economist Luis Torres. “As the labor market shows signs of cooling, employment growth in Texas has slowed to 2.3% so far this year. In addition, growth expectations for the second half of the year are down 0.8 percentage points from the first half. The slowdown in employment growth, coupled with the decline in Texas and the U.S. The decline in leading indexes lowered this forecast.

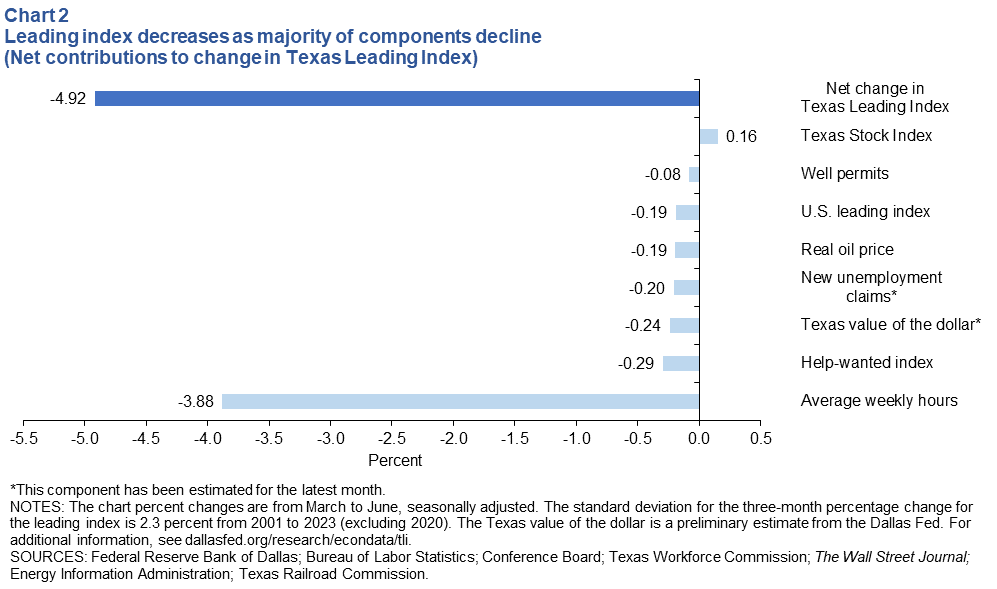

The Texas Leading Index declined in the three months through June (figure 2). All components fell except for the Texas Index, which contributed positively. The sharp decline in the index is due to a significant drop in average weekly working hours. Declines in the job search index, oil prices, the U.S. Leading Index and oil well permits also pushed the index lower. Additionally, a stronger U.S. dollar and new jobless claims in Texas also weighed on the index.

next version: August 16, 2024

method

The Dallas Fed's Texas Employment Forecast forecasts employment growth over the past year and estimates it based on the 12-month wage employment change from December to December.

The forecast is based on the average of four models. The three models are vector autoregressions in which Texas employment is regressed on lags of West Texas Intermediate (WTI) oil prices, the U.S. Leading Index, and the Texas Leading Index. The fourth model is an autoregressive dispersed lag model in which wage employment is regressed on lags of wage employment, current and lagged values of U.S. GDP growth and WTI oil prices, and Texas COVID-19 hospitalizations through March 2023. All models include four COVID-19 dummy variables (March to June 2020).

See dallasfed.org/research/forecast/ for more details.

Contact information

For more information about Texas employment forecasts, please contact Luis Torres at luis.torres@dal.frb.org.