Substack from Robert Bryce

FoMoCo lost $58,391 per electric vehicle sold during the quarter.

Scandals surrounding Ford Motor Company's electric vehicles continue to swirl. This afternoon, the company reported a $1.224 billion loss from its electric vehicle business in the third quarter. In early October, the company reported that electric vehicle sales “grew 14.8%, reaching a record high of 20,962 units sold.” So simple division shows the storied automaker lost $58,391 on every electric vehicle it sold during the quarter.

In the first nine months of 2024, losses from the company's electric vehicle business (known as Model e) totaled $3.7 billion. For reference, the $3.7 billion loss is equivalent to the gross profit (what Ford calls EBIT, short for earnings before interest and taxes) of Ford Blue, its internal-combustion engine vehicle manufacturing unit.

Alas, these results are not surprising. Ford has been splashing cash on electric vehicles over the past two years. In 2023, Ford's loss on electric vehicles will be US$4.7 billion, and in 2022, its loss on electric vehicles will be US$2.2 billion. Chief Executive Jim Farley and his lieutenants don't understand what motorists want to buy. That's a bad thing when you run one of the largest automakers in the world.

FoMoCo reported a third-quarter loss two months after announcing the cancellation of a planned three-row all-electric SUV. In August, the company said: “With pricing and margin compression, we have decided to adjust our product and technology roadmap and industrial footprint to achieve positive EBIT within the first 12 months of all new model launches. goal.

In other words, Ford warned two months ago that it would have to slash prices on electric vehicles and that third-quarter results would be disastrous. Indeed. Also in August, the company said it would move some battery production from foreign factories to U.S. plants in order to qualify for more federal subsidies under the Inflation Reduction Act. As I reported here last year, Ford and other automakers are aiming to raise tens of billions of dollars through a 45x IRA tax credit for companies making batteries in the United States. For example, Ford is building a battery factory in Marshall, Michigan, which is expected to create about 4,200 jobs. According to Good Jobs First, each job at Ford's new factory will cost taxpayers $3.4 million.

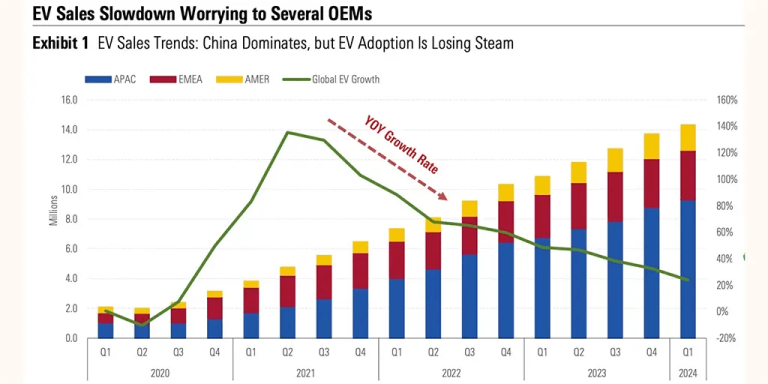

From Morningstar: “Are EVs short-circuited? Automakers revamp electrification strategies after demand slows”.

While Ford claims its sales are up, the underlying issues with the electric vehicle market haven't changed. As seen above, credit rating agency Morningstar, which predicted huge growth in electric vehicles 13 months ago, has now turned negative on the sector. The October 21 issue was titled “Is the electric car short-circuited?” Automakers revise electrification strategies after slowing demand” (Registration required) Major automakers including Volkswagen, Ford, General Motors and Mercedes have postponed or cut electric vehicle plans due to weak sales, Morningstar said planned output. Morningstar noted that while some automakers, including Ford, have cut prices, this has hurt their profitability. It also said EVs are struggling to maintain continued sales momentum among mainstream consumers as “EV sales to early adopters appear to have been exhausted.”

Morningstar then listed the problems that have plagued electric vehicles for decades:

EV range is still significantly affected by extreme weather conditions, with cold weather (i.e. below 40 degrees Fahrenheit) potentially reducing range by approximately 25%. Public EV charging stations have a poor reliability record, fueling concerns about EV charging infrastructure. Furthermore, despite significant developments in recent years, charging times are still much longer than the typical time required to refuel a vehicle with a conventional internal combustion engine. Additionally, while EVs have fewer parts than ICE vehicles and generally require less maintenance than ICE vehicles, one-time repairs (especially when it comes to EV battery packs) can be very expensive. As a result, insurance premiums for electric vehicles are typically higher than for comparable internal combustion engine vehicles in most jurisdictions, primarily because repair costs can be significantly higher. (Emphasis added.)

This paragraph provides a good summary of the EV market, especially with regard to cold weather, charging infrastructure, and charging times. (For more on the issue of repair costs, see this story from Hertz.) All of these problems have been evident since Edison's day. So why didn't Ford and other automakers see this disaster coming? Is this a herd mentality? Are they responding to government pressure? If so, why don't they fight back? What do they know about EV demand from their own market research?

My prediction: In a few years, after automakers have lost billions on bad bets on electric vehicles, business schools and analysts will be asking the same question.

Relevant