While the $300 billion per year climate finance commitment set at COP29 is a first step in helping to close the climate finance gap, the upcoming update of the Nationally Determined Contributions (NDCs) in 2025 provides opportunities for participants to further collaborate and enable expansion Scale comes from financing from all public and private sources. Achieving this will require significant progress in improving the quality, transparency and coverage of national-level climate targets and related estimates of climate finance needs.

How big is the climate finance gap?

Although climate finance has grown at an unprecedented rate in recent years, reaching US$1.46 trillion by 2022, these financial flows remain below global demand. CPI's latest “Global Climate Finance Landscape” shows that by 2030, the world will need to invest nearly US$7.4 trillion per year, of which emerging markets and developing economies (excluding China) will need at least US$2.4 trillion. Furthermore, emerging market and developing economies tend to be the most vulnerable to the impacts of climate change, despite their relatively low contribution to global greenhouse gas emissions.

For example, Africa is one of the regions most vulnerable to climate impacts and has historically lost 10-15% of GDP per year due to climate change, but its mitigation and adaptation actions are severely underfunded. The continent's annual climate flows in 2021/22 represent just 23% of the estimates African countries need to implement their Nationally Determined Contributions and meet their climate targets by 2030. Target.

How much international support is needed to meet EMDE's climate finance needs?

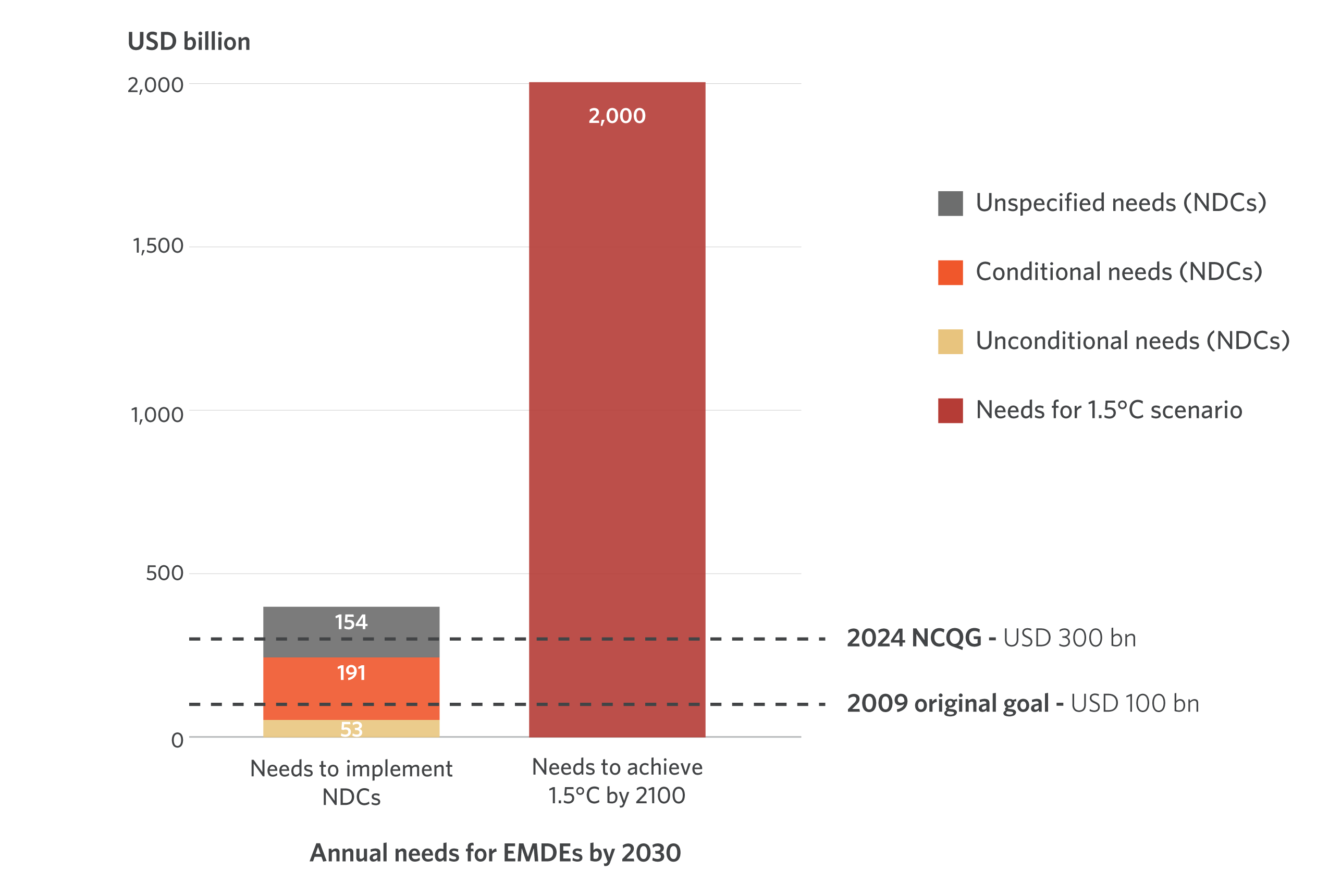

The New Collective Quantitative Targets (NCQG) on climate finance set at COP29 set a new goal for developed countries to mobilize $300 billion per year for climate action in developing countries by 2035. .

This gap in financial commitments has also put renewed focus on the implementation of Nationally Determined Contributions (NDCs), which outline each country’s climate action plans.

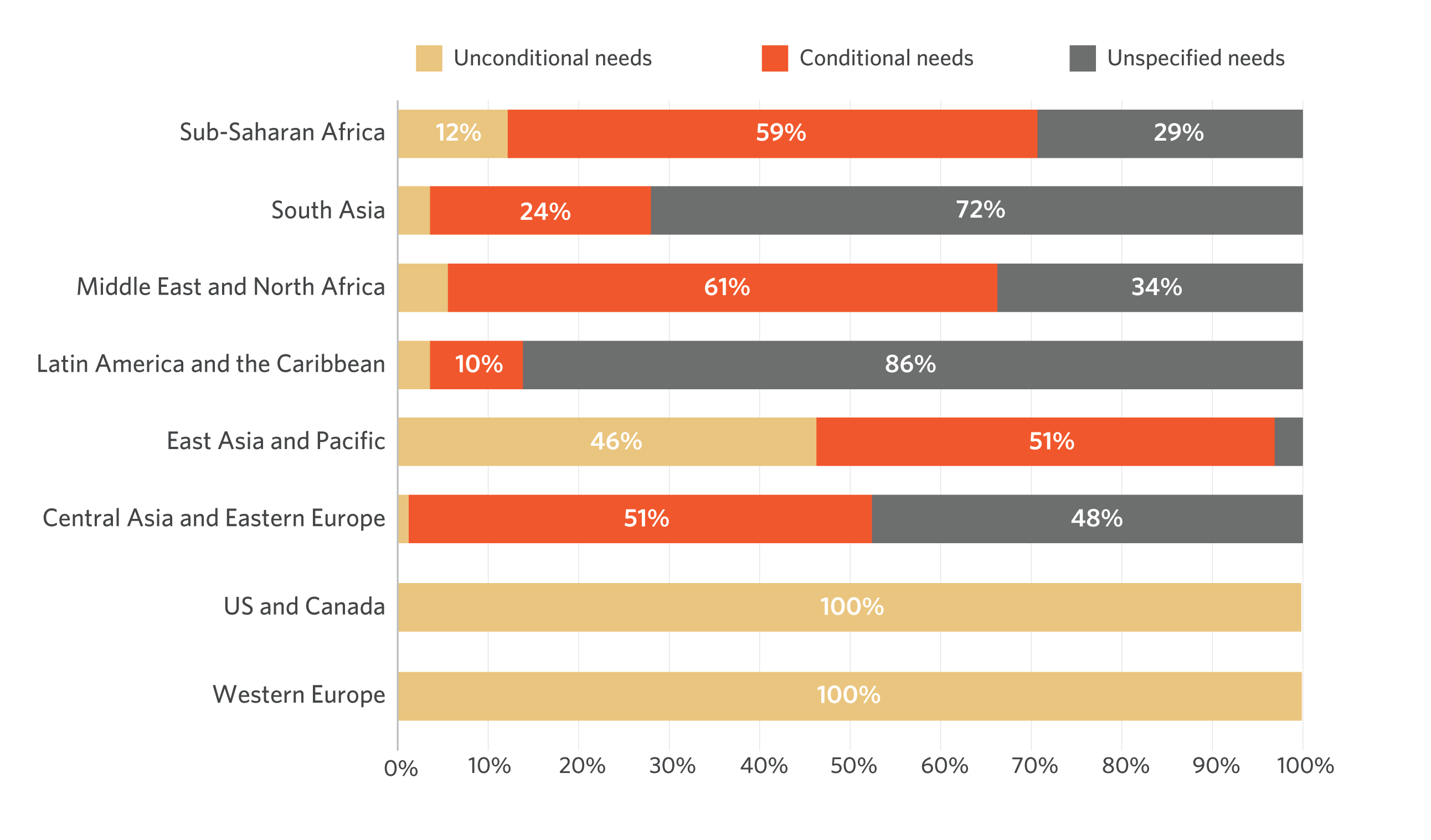

The annual climate financing needs of emerging market economies, outlined in existing NDCs, are US$400 billion. Only 13% of needs are classified as financeable from domestic public sources (known as “unconditional” contributions). The remaining climate finance gap will require international funding (“conditional”).

Nationally Determined Contributions and the Future of International Climate Finance

As mentioned above, the needs stated in the NDCs are well below the total global financing required for a 1.5°C adjustment, and this does not even take into account countries that have not yet quantified their climate finance needs in their NDCs.

Figure 1: Unconditional, conditional and unspecified needs for each country’s Nationally Determined Contributions, by region (%)

As countries prepare for the next round of Nationally Determined Contributions (NDCs) in 2025 (the Paris Agreement requires Parties to submit updated NDCs to the UN Framework Convention on Climate Change every five years), they must strengthen their upcoming NDCs. The ambition of the Nationally Determined Contributions to help provide a clear signal to countries is crucial.

Figure 2: NCQG and NDC ambitions compared with global climate finance needs in the EMDE 1.5 °C scenario [1]

Limitations of country-level demand estimates

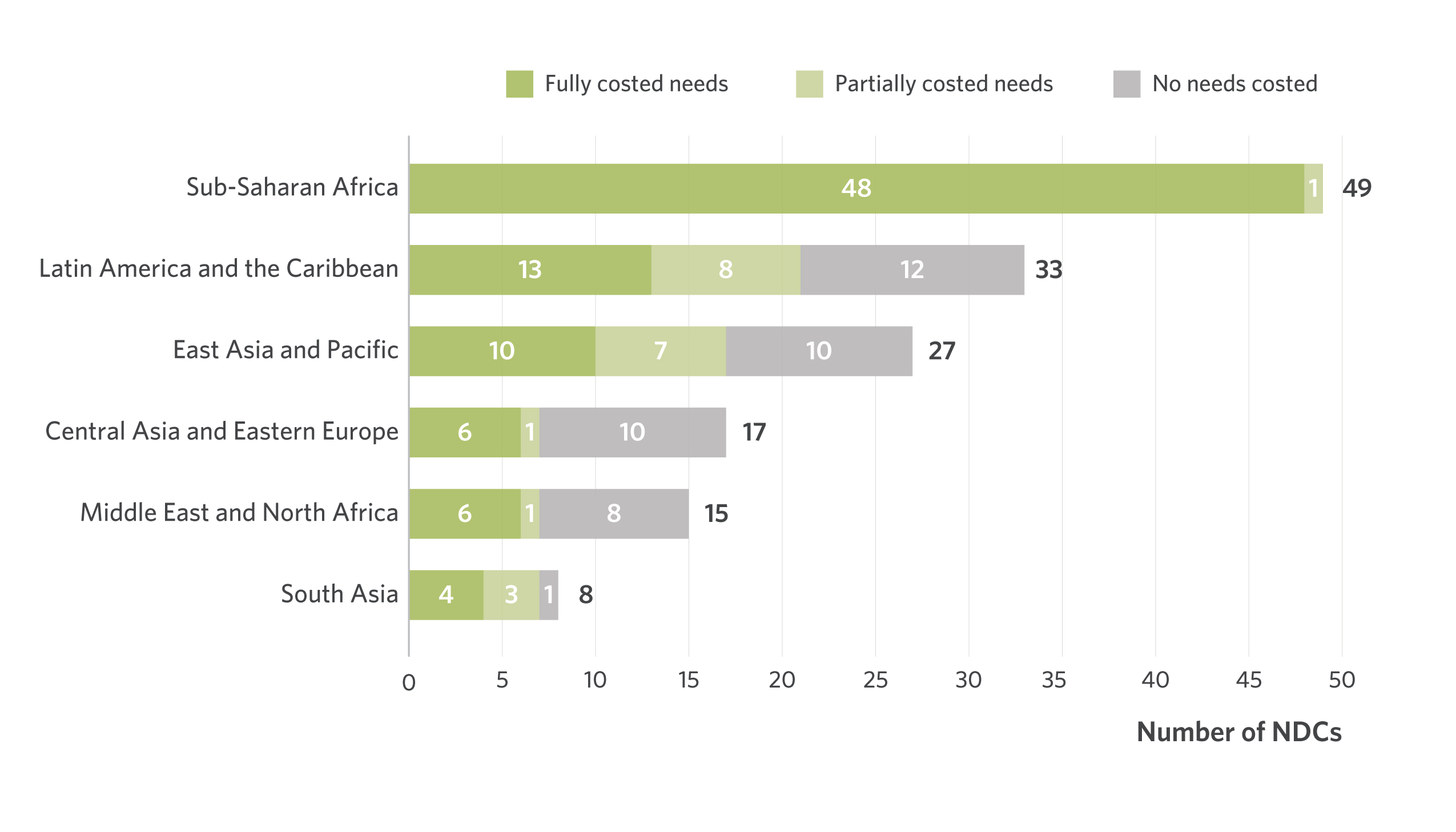

Substantially improved estimates of country-level climate finance needs are therefore needed. While some countries estimate their climate finance needs using projection models consistent with 1.5°C warming pathways, most countries derive their needs from a range of costed mitigation and adaptation measures or projects they aim to implement. of. Furthermore, many countries have only partially quantified the amount of funding required to implement their NDCs, while some do not do so at all. More than a quarter of the NDCs of emerging market and developing economies do not include quantified climate finance needs (see Figure 3). For NDCs that quantify climate finance needs, the methods used to estimate these needs are not standardized.

Figure 3: National Data Center (NDC) Climate Finance Needs Coverage EDME (by region)

There is also no clear structure or mandatory topics that must be covered in each country’s NDCs, meaning that the scope and coverage of needs are inconsistent across regions and countries. The sectors and subsectors covered by NDCs also vary widely, with many sectors not disaggregating their financing needs at the sectoral level.

Estimates across countries lack granularity and standardization, making it difficult to compare or aggregate needs and provide an incomplete picture of the amounts needed to address urgent climate challenges, especially in the most vulnerable countries.

Recommendations for strengthening national climate finance targets

- Improving coherence among nationally determined contributions: The UN Framework Convention on Climate Change can develop methods and guidance to help countries set appropriate and transparent Paris climate targets and accurately calculate the investment costs required to achieve them. While NDCs primarily reflect national priorities, countries should also consider investment needs at the global level to ensure that their targets are aligned with the 1.5°C trajectory and promote global climate resilience. Guidance on standardizing other topics in NDCs, such as adaptation, loss and damage, and definitions of conditional versus unconditional finance, would also help build more comprehensive estimates of climate finance needs and make them more consistent across countries and regions. are more comparable.

- Encourage public-private collaboration in Nationally Determined Contributions to achieve greater collective climate action: Meaningful private sector participation in the design and revision of Nationally Determined Contributions and National Adaptation Plans is critical to inform public policy and investment priorities. By outlining public investment priorities in NDCs, governments can create an enabling environment for private investment. Improved domestic financing targets in these documents will demonstrate a strong commitment to climate goals, building confidence among private and international investors. Governments can provide policy consistency on estimated spending on public goods such as information systems and infrastructure, which can encourage closer alignment of the private sector with NDCs.

- Increase international capacity building support: Preparing and improving NDCs can be a challenge for emerging market and developing economies with limited capacity. Development agencies and private consulting groups can provide additional technical expertise, data infrastructure and capacity-building programs to produce accurate forecasts.

- Improving the accountability framework: Robust measures are needed to track progress towards NDCs to ensure accountability. The UNFCCC should establish tracking and reporting procedures to measure the amount of funding committed and implementation of NDC targets. Improving transparency on countries’ progress towards climate goals can reveal investment gaps, promote accountability and encourage greater ambition in future target setting.

Beyond NCQG

While NCQG is a focus of this year's COP29 negotiations, it is important to remember that NCQG is only one part of the equation. Closing the climate finance gap requires all Sources of funding – domestic and international, public and private – to close the global climate investment gap. The focus must now shift immediately to taking meaningful action.

As global climate leaders move from Baku to Belem next year, CPI’s work remains critical to understanding the sources, tools, uses and needs of public and private sector climate finance to help drive large-scale global climate action.

[1] International HLEG, 2022. FFinancing climate action: Scaling up climate and development investments. URL: https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2022/11/IHLEG-Finance-for-Climate-Action-1.pdf