The climate financial gap in least developed countries is Provenbut the practical way to close it is still limited.

The least developed countries (latest developed countries) are the countries that are most likely to aggravate climate risks, although causing the least climate change. Challenges related to economic stability, fiscal space and policy environments often hinder their ability to attract climate investment or respond to disasters.

Even if the Public Development Financial Institutions (DFIS) increase adaptive financing, countries adapt to climate hazards will receive lower countries receiving countries receiving less than those able to respond. Of the total adaptive financing tracked to Africa in 2022, only 11% belong to the 10 most climate-friendly countries in the ND-Gain rankings. In terms of emissions, LDC received only 1% of global mitigation financing in 2022.

As climate funders and countries prepare for the Fourth United Nations International Conference on International Development and Development (FFD4) in Sevilla, three non-lost aspects of climate financing in LDCs are considered in a timely manner:

1. How does DCS try climate solutions and financial innovations to manage its risks?

2. Why are current climate financial mechanisms not always meeting the needs of least developed countries?

3. How do different public actors play a role in promoting adaptive climate financing in these countries?

1: Least developed countries as innovators in climate action

People have long faced high climate risks, and LDCs have been forced to innovate to build resilience. For example, Bangladesh (due to its low-lying delta location, one of Bangladesh – one of the most vulnerable countries in the world, has dramatically improved its resilience to cyclones over time. Although Bhola caused nearly half a million deaths in 1970, a similar storm of the super cyclone Amphan died in 2020 with only 26 deaths, with deaths avoiding early warning systems, cyclone shelters and community training. The sharp decline illustrates how national and local leaders can save lives in combination with long-term investments in preparing for disasters.

Nevertheless, the devastating economic losses caused by Amphan on the subcontinent demonstrate the need to pair climate venture capital with innovative financial instruments, thereby enhancing economic and livelihood resistance.

The following two examples show how context-specific instruments can help close the climate financing gap.

Parameter protection through ARC

LDCs need more support to ensure that climate disasters do not overwhelm the already stretched public budget. When extreme weather events occur, emergency spending further limits fiscal space, exacerbating debt and human suffering.

The African Risk Capacity Group (ARC) provides rapid financing to support response, recovery and reconstruction after climate-related disasters. Remedies are carried out through the sovereign risk pool promoted by the African Union and ARC Insurance Company Limited (Arc Ltd.), most of which are LDCS. Expenditure is released when certain climatic conditions are met.

For example, in 2022, Arc Ltd. and the African Development Bank released $5.37 million to Zambia, where prolonged droughts have led to widespread food insecurity. The subsequent government electronic cash transfer to farmers enables them to diversify and increase their income, including through opening small livestock businesses.

Donor capital is essential to maintaining affordable and timely coverage of ARC. In addition to the commitments from African governments and regional/local financial institutions that are being absorbed by ARC, the UK and Germany provide long-term, interest-free financing for £30 million and US$48 million, respectively. This support helped Arc Ltd. maintain Fitch’s Type A insurance company financial strength rating, keeping its premium affordable, resolute and close to expanding it to a $100 million insurer.

ARC demonstrates how donor capitalization enables climate insurers to serve in high-risk, low-resource environments. By injecting patient capital into the sovereign risk pool, donors can proactively manage climate shocks, thereby opening up fiscal space, improving the timeliness of disaster responses, and protecting lives and livelihoods.

Clean energy is in line with peace construction through P-REC

Support is also crucial in situations where climate vulnerability overlaps with chronic energy poverty and conflict risks. Of the 800 million people worldwide lacking electricity, 80% live in fragile, conflict-prone states. These complex vulnerabilities make it difficult to fund the energy infrastructure needed for sustainable development.

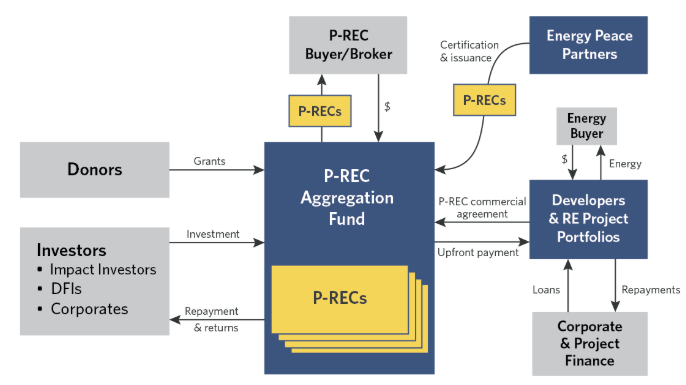

Peaceful Renewable Energy Credit (P-REC) Aggregation Facilities Address this challenge by directing revenue to clean energy projects in conflict-affected countries. Like standard renewable energy credits, each P-REC represents 1 MWH of clean energy, but is uniquely issued for the first electrification project in conflict-affected areas. Developers can sell these points to buyers of companies seeking to offset their emissions, creating an additional source of revenue.

The P-REC aggregation facility uses an active peace framework to track improvements in community stability and resilience. For example, sales of P-REC of Goma 1.3 MW solar small movement in the Democratic Republic of the Congo, funded community street lights and electrification. These investments are linked to improvements in local SDG indicators and residents’ safety perceptions, while supporting job creation, improved reliability of health and education services, and opportunities for cooperation and peacebuilding.

The P-REC facility is funded by eight charities, supports early tool development and helps brokers establish partnerships with corporate buyers including Google, Microsoft and Coca-Cola. Linking company climate commitments to investments in hard-to-reach markets is critical to replicating and expanding the impact of smaller interventions.

CPI and its partners support climate finance and catalytic climate financing facilities through the Global Innovation Laboratory to support the development of P-REC, which is designed by:

By eliminating early-stage investments, philanthropy avoids weak and favorable environments and highly perceived risks to expand free consultancy P-REC, thus bringing corporate financing to meet community energy needs.

While the examples above show context-specific innovations, many current climate finance approaches do not fit the macroeconomic and institutional realities of developed U.S. countries.

2. Why the current climate finance has failed.

The international financial system must be restructured to tailor climate finance to address the restrictions of least developed countries, rather than following the approach used in more developed economies. Climate financing in least developed countries should prioritize grant-based and preferential resources to avoid deepening debt distress.

Cross-border climate financial mechanisms that depend on debt often assume a stable macroeconomic environment, predictable regulatory regimes, and the existence of financial intermediaries – conditions that rarely exist in LDCs.

LDCs face similar (but more acute) challenges that challenge emerging markets. These include:

- Limited financial space: Many least developed countries are debt-allocated and cannot afford additional borrowing. This could ban debt mechanisms that are typically deployed to fund climate projects due to costs or future economic impacts.

- Weak favorable environment: Climate financing mechanisms based on strong policy environments or monitoring and assessment capabilities in strong policy environments or monitoring and assessment capabilities (e.g., climate swaps, resulting payments and catastrophic bonds held) may not be feasible in many underdeveloped countries.

- Currency risk: In the presence of opportunities for climate lending, large amounts of foreign exchange (FX) risks increase borrowing costs in least developed countries and expose them to currency fluctuations that exacerbate the debt burden of foreign lenders.

- Project-level issues: Small transaction sizes, limited pipelines, and delicious LDC climate projects lack the performance of holding bonds, prohibit developers from attracting investment.

Given these challenges, LDCs cannot rely on current debt-centric international climate finance mechanisms that require market and institutional capacity. Strengthening domestic markets and institutions remains a key long-term goal; however, climate financing must meet current MIT holdings, prioritizing emergency adaptation and resilience requirements. In practice, this means high discounts – ideal, grant-based finance.

Some of these support is appropriate similar to humanitarian or development assistance. The climate and development outcomes of least developed countries are closely linked, and both are neither practical nor beneficial.

3. The role of highly favorable financial providers

Different public actors can play different roles in increasing climate financing in least developed countries. Charity, nonprofits and donor governments can deploy flexible, non-returned capital, while DFI can deploy low or no interest loans to supplement domestic government priorities.

The following table captures the key roles and comparative advantages of each institution type:

| Institution type | Core functions | Unique role in supporting developed countries |

|---|---|---|

| Donor Government | Provide ODA as a discount or grant-based capital. Support national policy environment and technical capabilities. | Large-scale resources, clear climate mandates and obvious risk tolerance enable donor governments to fund disaster recovery, technical assistance facilities and help build mixed financing suitable for free remittances. |

| Natural Government | Set national priorities, deploy public budgets for climate efforts and coordinate external support. | In many least developed countries, it is already the largest source of adaptation funds. With additional financial space or international support, they can lead context-appropriate community-based resilience. Cross-troop coordination can better articulate national climate priorities for further international support. |

| Public Network (NDB, climate fund, DFI including MDB) |

Offers discounts and flexible financing. Building capacity, support policy integration and project preparation. Coordinate funders and integrate climate into development efforts. | Prioritizing grant style capital, local monetary financing and long-term technical assistance can go beyond the market's ability to rely on market debt instruments. Some public places are also suitable for investing in regional risk pools and mitigating FX/credit risks. |

| Charity, Foundation, Nonprofit Organization | Early-stage investments that reduce risk by funding new models and piloting financial structures in high-risk or underdeveloped markets. Catalytic project pipeline. |

Charitable funds are more flexible than ODA and can become a powerful catalyst for private investment. It can also reduce local capabilities in an unproven market and reduce (perceived and real) risk. |

The way forward

In order for climate financing to be just and effective, those with the least resources and the greatest needs must be prioritized. LDCs are already driving innovations in climate policy and finance, but closing the climate investment gap will require intentional and coordinated action.

National efforts must be complementary to system reform and expanded through international support. Donor governments, philanthropy and DFIS should not prioritize grant-based or highly favorable capital to suit the priority of climate financial instruments that absorb risks and enhance local capacity.

When leaders prepare for FFD4, they must turn to action – to build a more inclusive climate financing system for MIT. The opportunity to promote the goals of the Bridgetown Initiative and shape a more inclusive international financial system is clear and tools already exist.

Doing so will require a focus on leveraging catalysis, offers and specific environment capital to ensure that the most vulnerable are not left behind.

Note: A list of least developed countries can be found here: https://www.un.org/ohrlls/content/list-list-ldcs